How it Works

WPP, Havas, Omnicom: Are advertising’s biggest holdcos recasting agencies as AI Operating Systems?

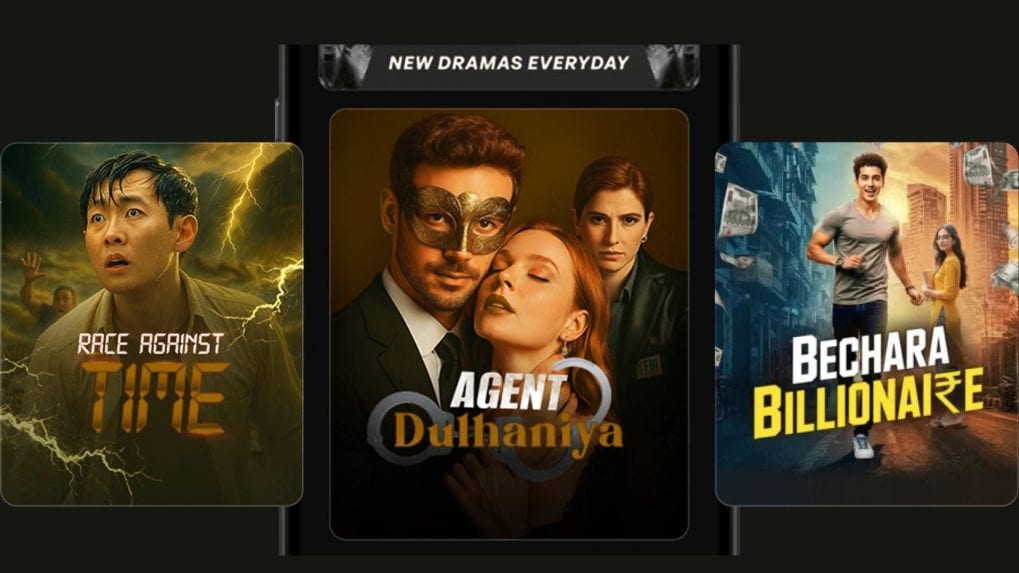

India’s micro-drama market is entering a decisive growth phase, with new data indicating that the category is witnessing a J-curve inflection driven by rapid user adoption, high-intensity content preferences, and migration away from traditional short-form video formats.

According to Redseer’s consumer survey and market analysis, India’s micro-drama segment has recorded nearly 2x growth in a span of two months, signaling early momentum in what could become one of the fastest-growing formats within interactive digital media.

Metro, Tier-1 users anchor early demand

The current micro-drama audience is concentrated in Metro and Tier-1 cities, with users gravitating toward high-aspiration, emotionally charged narratives. The survey of 661 users shows the audience skews male, salaried, and middle-income, with 65 to 70 percent of viewers being men and the core age cohort falling between 25 and 45 years.

Most users are financially independent, with a significant share earning between ₹5–25 lakh annually. Employment data shows salaried professionals form the dominant segment, reinforcing the idea that micro-dramas are finding early traction among working adults rather than student-heavy audiences.

Redseer notes that this demographic profile reflects an early-adopter cohort capable of anchoring scale before the market reaches saturation.

High-aspiration genres dominate viewing

User preference data indicates that micro-drama consumption is being driven by high-dopamine, high-intensity genres rather than casual or ambient viewing formats.

Romance leads genre preference with 41 percent of users indicating it as their most-watched category, followed by crime and family drama. Fantasy remains a smaller but visible segment. Within these categories, aspirational storylines such as billionaire fantasies, revenge arcs, crime thrillers, and emotionally charged family narratives are drawing the strongest engagement.

These themes mirror user demand for dramatic payoff per scroll, a factor Redseer identifies as central to why micro-dramas are increasingly replacing short-form video in certain consumption windows.

Users substituting SFV, not adding new screen time

One of the most significant insights from the data is that micro-dramas are not additive media consumption for most users. Instead, they are substituting existing formats, particularly short-form video.

More than 95 percent of micro-drama consumption is non-additive, with users primarily shifting away from Instagram Reels and YouTube Shorts. A smaller share substitutes OTT shows and TV serials, while gaming and audio series see limited displacement.

Only around 3 percent of users reported micro-dramas as an entirely new form of media consumption, reinforcing the idea that platforms are competing for the same attention windows rather than expanding total screen time.

Micro-dramas are most commonly consumed during casual daytime scrolling sessions at home, idle moments outside the home such as commuting, and as part of nighttime wind-down routines.

Content velocity, not pricing, drives churn

Despite rapid uptake, the category faces clear retention challenges. The biggest pain points identified by users are slow content refresh cycles, repetitive storylines, and uneven production quality.

Content velocity and storytelling freshness rank significantly higher as concerns than pricing, with high subscription costs notably absent as a major friction point. Redseer highlights that users are willing to pay as long as the content delivers consistent novelty and quality.

Voice-of-customer feedback within the study indicates fatigue around overused billionaire and crime themes, with users calling out limited genre experimentation and predictable plotlines as reasons for reduced viewing time.

Monetisation heavily dependent on UPI autopay

Monetisation data shows a strong reliance on UPI autopay, with roughly 71 percent of users paying for micro-dramas through UPI. Wallets, debit cards, credit cards, and gift cards play a secondary role.

However, this dependency also introduces vulnerability. If UPI autopay were discontinued, only 12 percent of users say they would continue subscribing without hesitation. Around 58 percent indicate they would reduce or rethink payments, while nearly 30 percent say they would shift between free and paid formats.

This creates a mild churn risk across income segments, particularly if payment friction increases or regulatory changes disrupt autopay mechanisms.

Micro-dramas emerge within interactive media boom

The rise of micro-dramas is occurring alongside a broader inflection in India’s digital media and entertainment landscape. Interactive media, which includes micro-dramas, audio streaming, social discovery, and emerging formats such as astro and devotional tech, is projected to become a $3.1–3.4 billion market by FY30.

Within this ecosystem, micro-dramas are expected to be among the fastest-growing segments, with projected growth rates significantly outpacing traditional short-form video as platform diversification accelerates.

Redseer’s analysis suggests that sustained growth will depend on whether platforms can scale content output, improve storytelling diversity, and reduce over-reliance on narrow genre templates while maintaining high engagement intensity.

For now, India’s micro-drama market appears to be moving decisively past its experimentation phase and into early-scale execution.

From purpose-driven work and narrative-rich brand films to AI-enabled ideas and creator-led collaborations, the awards reflect the full spectrum of modern creativity.

Read MoreThe Storyboard18 Awards for Creativity have unveiled a Grand Jury comprising some of India’s most influential leaders across advertising, business, policy and culture, positioning it among the country’s most prestigious creative award platforms.