How it Works

WPP, Havas, Omnicom: Are advertising’s biggest holdcos recasting agencies as AI Operating Systems?

The Enforcement Directorate’s Gurugram Zonal Office has provisionally attached movable and immovable assets worth ₹117.41 crore belonging to Probo Media Technologies Pvt. Ltd. and family members of its directors, escalating its money laundering investigation into the controversial online prediction platform.

The attachment, executed on December 9, covers fixed deposits, investments in shares, demand drafts, bank balances held in the company’s name, and several residential apartments owned by relatives of the promoters, according to an official release.

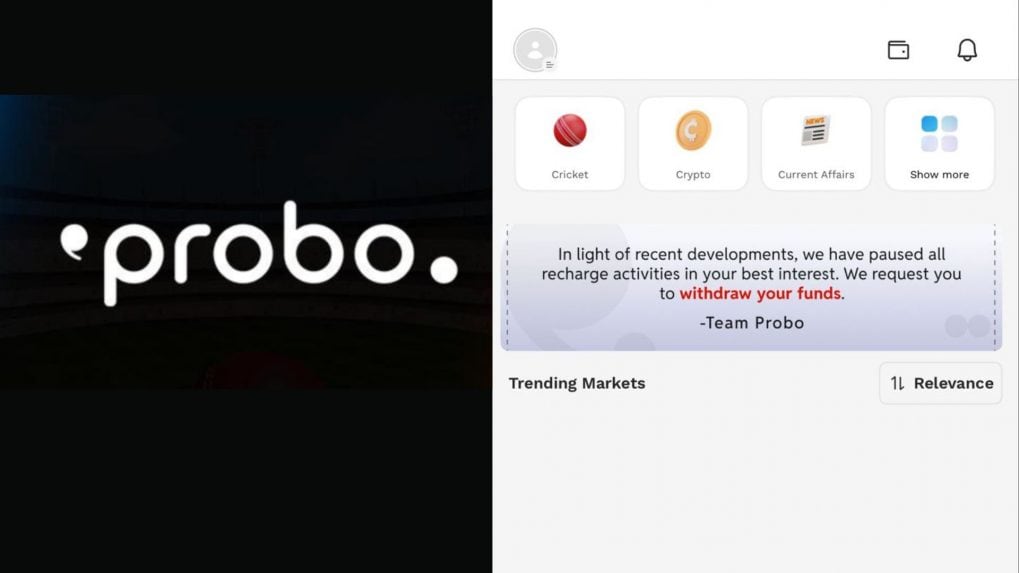

Probo Media operates the app and website Probo, which investigators allege promoted online gambling under the guise of “online gaming”. The platform, popular for its “yes/no” prediction-based questions on current events and market outcomes, suspended operations in August 2025 after the Promotion and Regulation of Online Gaming Act, 2025 came into force.

The agency initiated its investigation on the basis of multiple FIRs filed in Gurugram and Palwal (Haryana) and Agra (Uttar Pradesh) under the Bharatiya Nyaya Sanhita (BNS), 2023 and the Public Gambling Act, 1867. Complainants alleged they were misled with promises of easy earnings through simple prediction questions, while the underlying mechanism allegedly constituted gambling.

According to the FIRs, users were “cheated and dishonestly induced” to participate in what was portrayed as a skill-based gaming opportunity.

The ED’s findings indicate that Probo Media misrepresented itself as a skill gaming platform, while actually facilitating online betting activities. The agency claims the company, through its promoters and directors, generated proceeds of crime worth approximately ₹1,245.64 crore via these activities.

The financial investigation has focused on tracing funds, including investments and profits accumulated from platform operations before the regulatory clampdown.

This is not the first enforcement action against the company. During coordinated searches conducted on July 8 and 9, 2025, the ED froze ₹284.5 crore worth of fixed deposits and shareholdings under Section 17(1)(a) of the Prevention of Money Laundering Act (PMLA), 2002.

The agency stated that further investigation is underway to trace additional assets, beneficiaries, and money flows associated with the alleged gambling operations.

In a major financial finding, the company is said to have raised ₹134.84 crore through issuance of preference shares to foreign entities based in Mauritius and the Cayman Islands, raising red flags over suspected round-tripping and FDI compliance.

The ED's search resulted in the seizure of incriminating documents and digital evidence. Assets worth ₹284.5 crore—held in fixed deposits and shares—have been frozen, alongside three bank lockers.

From purpose-driven work and narrative-rich brand films to AI-enabled ideas and creator-led collaborations, the awards reflect the full spectrum of modern creativity.

Read MoreThe Storyboard18 Awards for Creativity have unveiled a Grand Jury comprising some of India’s most influential leaders across advertising, business, policy and culture, positioning it among the country’s most prestigious creative award platforms.