Advertising

From Pink Slips to Silent Sidelining: Inside adland’s layoff and anxiety crisis

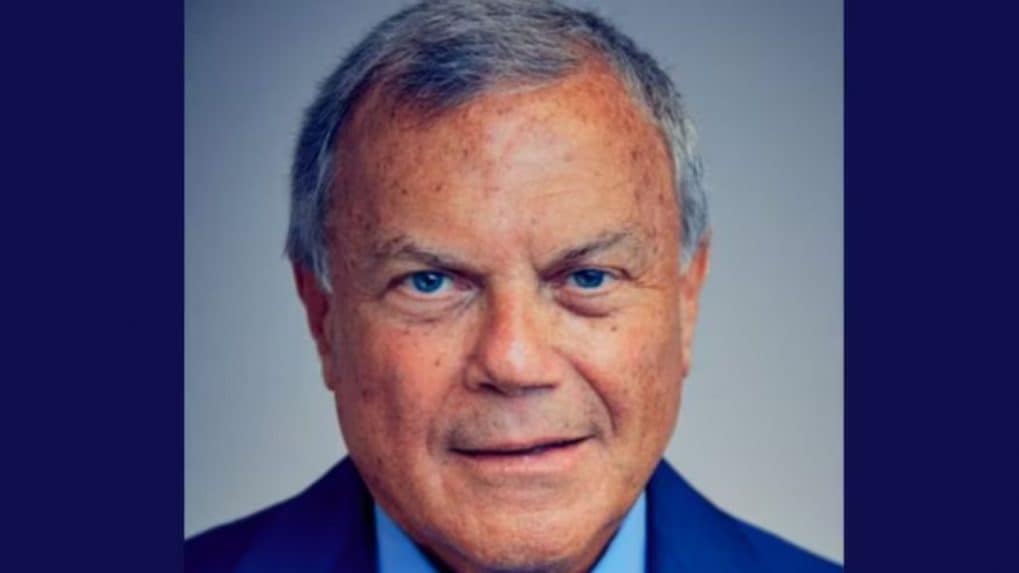

Sir Martin Sorrell, Founder and Executive Chairman of S4 Capital/Monks, says the global advertising industry is headed into a period of slower growth, higher costs, and existential disruption from AI — one where “brainpower, not discounts, will define the next era.” In a conversation with Storyboard18, Sorrell weighed in on tariffs, the Omnicom–IPG merger, and WPP’s leadership troubles, while stressing India’s importance as a growth market.

On trade wars, he warned that tariffs were only “layered on top of bigger geopolitical issues like US–China relations, Russia’s objectives, and Iran’s activities in the Middle East. These three issues are extremely difficult to deal with, despite what leaders may say. When you add tariffs, you get tremendous uncertainty.”

He added that growth will be harder to find in the coming years, which makes markets like India disproportionately important. “In that environment, finding growth becomes harder, which makes markets like India much more attractive. At the same time, efficiency and effectiveness are critical — AI, quantum computing, blockchain, and the metaverse will be vital tools.”

For Indian advertisers, the fundamentals remain strong, but infrastructure is the biggest constraint. “India’s backdrop is extremely strong. GDP growth of 5–6%, being the fifth largest economy, and favorable demographics compared to China give India an advantage. The big challenge is infrastructure — both physical and digital. Delhi and Mumbai, for instance, are already under huge strain. Productivity will be affected if infrastructure doesn’t keep up with growth.”

On media buying, he repeated his call for open-book practices. “You must run an open book. It’s remarkable that in this day and age, many clients still don’t know what they’re paying in certain markets like Japan. Dentsu and Hakuhodo, for instance, aren’t transparent on pricing.”

“At S4 we only buy digital — $5–6 billion of inventory from Google, Meta, Amazon, Tencent, TikTok, ByteDance, etc. — and do it on a transparent basis, charging a fee. The holding companies are now trying ‘proprietary media buying on an open basis,’ which is really transparently untransparent. I don’t think it will last. In an era of blockchain and AI, supply chains will be shortened and exposed, making hidden volume discounts a thing of the past.”

On the Omnicom–IPG deal, Sorrell was blunt: “Omnicom–IPG is a cost-cutting merger, not about growth. We’ve already seen retention bonuses shrink from a year to six months — that signals churn. With 127,500 staff pre-deal, I doubt more than 110–115,000 will remain. It’s about cost savings, not revenue synergies.”

“Here in India, both groups have strong representation — IPG in creative (FCB, McCann), Omnicom in media and creative. Integration will be messy, with client and talent churn for at least two years,” he added.

Turning to WPP, the group he founded, Sorrell was sharply critical of its current direction. “WPP is different — it’s about poor leadership and brand mismanagement. Iconic names like Thomson, Ogilvy, Y&R, Wonderman, even AKQA, have been humbled. Putting Gray under Ogilvy — when Gray’s biggest client was P&G and Ogilvy’s was Unilever — was a disastrous move. It sends shivers through CMOs.”

On the appointment of Cindy Rose, a former Microsoft executive, as WPP’s new CEO, Sorrell said: “It remains to be seen. The problem isn’t structure, but leadership and brand degradation. Cindy Rose, now CEO, faces the tough task of cutting a new direction after years of weakening strong brands.”

“My view is WPP should be broken up. The argument for an integrated whole doesn’t hold up — specialization is more valuable in today’s market. Motivation within WPP has collapsed, and fixing that will be difficult. Collapsing brands like JWT, Wunderman, Y&R into VML doesn’t help. Outside of Kansas City (and maybe Taylor Swift and Travis Kelce), who knows VML?”

From purpose-driven work and narrative-rich brand films to AI-enabled ideas and creator-led collaborations, the awards reflect the full spectrum of modern creativity.

Read MoreLooking ahead to the close of 2025 and into 2026, Sorrell sees technology platforms as the clear winners. He described them as “nation states in their own right”, with market capitalisations that exceed the GDPs of many countries.