How it Works

WPP, Havas, Omnicom: Are advertising’s biggest holdcos recasting agencies as AI Operating Systems?

Timex Group India Ltd (TGIL) has reported a revenue of Rs 169 crore, marking a 55% YoY growth in the first quarter of FY26. The company also saw a 4.5x increase in EBITDA and six-fold jump in Profit Before Tax (PBT).

As per the company, Timex, the flagship brand, led the charge with a 77% YoY growth. While Guess Watches recorded a 33% rise and Versace grew by 18%.

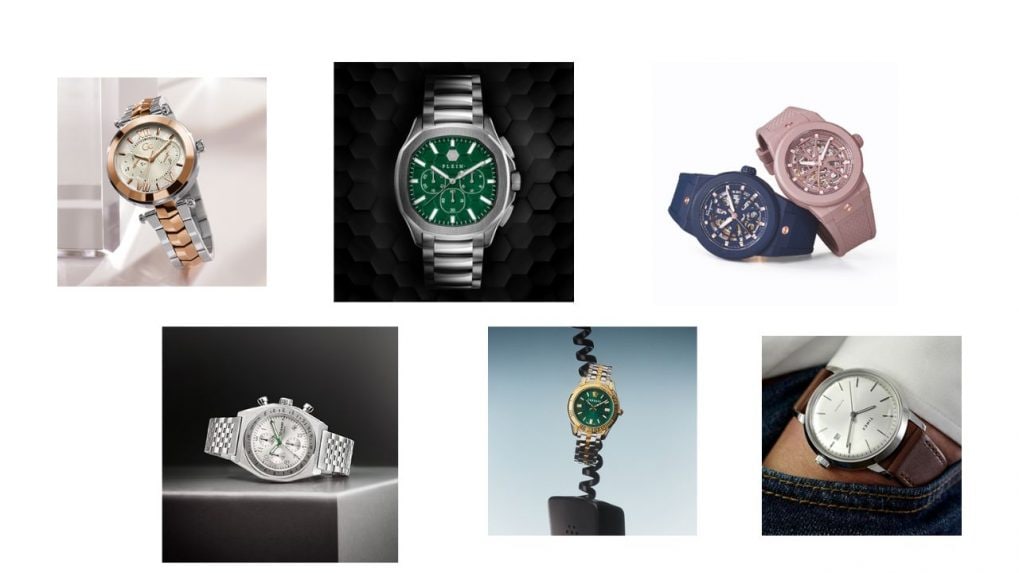

In addition to this, licensed brands including Gc, Philipp Plein, Plein Sports and Nautica maintained strong quarter-on-quarter momentum in the premium category.

Deepak Chhabra, Managing Director of Timex India said, “Our flagship brand, Timex, has delivered its best-ever performance this quarter, a clear reflection of our sharp focus on premiumisation, product innovation, and expanding consumer access. Growth across all channels and brands has come together to create this strong momentum.”

E-commerce soared with a 102% YoY increase, validating TGIL’s digital-first approach. Trade channel posted a 22% growth over a high base. Meanwhile, the OEM business delivered triple-digit gains, further strengthening TGIL’s strategic verticals.

Expansion continued with new retail stores in high-impact areas, while quick commerce gained traction, offering faster consumer access to core Timex collections.

Iconic collections like Q Timex, Marlin, Waterbury, Fria and Expedition continued to perform strongly. The brand’s global collaborations including partnerships with Jacquie Aiche, The New Yorker, Netflix’s Wednesday and Superman x Warner Bros, have helped enhance its fashion relevance.

Timex also launched the “Analog Life – Make Time Yours” campaign, a Gen Z and Millennial-focused movement that embraces simplicity and intentional living in an increasingly digital world.

In a major category expansion, TGIL debuted GUESS jewellery this quarter, tapping into the fast-growing fashion accessories market in India and expanding its lifestyle footprint.

From purpose-driven work and narrative-rich brand films to AI-enabled ideas and creator-led collaborations, the awards reflect the full spectrum of modern creativity.

Read MoreThe Storyboard18 Awards for Creativity have unveiled a Grand Jury comprising some of India’s most influential leaders across advertising, business, policy and culture, positioning it among the country’s most prestigious creative award platforms.