How it Works

WPP, Havas, Omnicom: Are advertising’s biggest holdcos recasting agencies as AI Operating Systems?

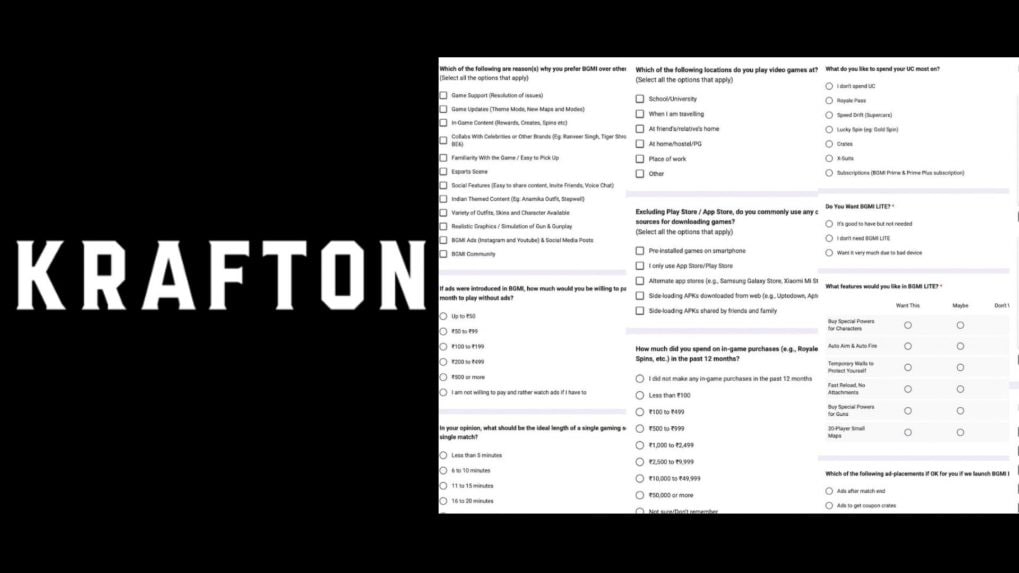

Krafton India has begun running an extensive in-game survey among BATTLEGROUNDS MOBILE INDIA (BGMI) players, seeking granular feedback on gameplay behaviour, spending patterns and, notably, attitudes towards in-game advertising—underscoring how India’s largest mobile gaming publisher is closely evaluating monetisation pathways amid a rapidly expanding market.

The survey, accessed by users within BGMI, spans a wide range of questions, including preferred gameplay locations, average in-game ping, lag issues, spending on UC (Unknown Cash), purchase behaviour over the last 12 months, and willingness to engage with advertising formats such as post-match ads, ads during matchmaking, or ad-linked reward crates. Players are also asked how much they would be willing to pay to avoid ads, with options ranging from under ₹50 to opting out of payments entirely.

Industry experts say the depth of the questionnaire suggests a strong intent to map user tolerance for advertising without disrupting gameplay—a delicate balance in competitive multiplayer titles.

“The Indian gaming audience is extremely price-sensitive but also highly engaged. Surveys like these help publishers understand exactly where ads can exist without hurting retention,” said a senior executive at a leading media agency, speaking on condition of anonymity.

However, Krafton India has sought to temper speculation around imminent ad rollouts. A Krafton India spokesperson told Storyboard18, “The question on monetization is a part of our regular user surveys we conduct from time to time. We don't have anything planned or under review for ad monetization.”

The timing of the survey is nevertheless significant. Krafton India has, over the past year, sharply accelerated brand collaborations within BGMI, positioning the platform as a cultural bridge between gaming and mainstream consumer brands.

Most recently, Krafton India and Royal Enfield announced a landmark partnership bringing the iconic Bullet 350 and the Continental GT 650 into the BGMI universe as rideable motorcycles. The collaboration marked one of the most prominent automotive integrations inside an Indian mobile game, blending Royal Enfield’s legacy with interactive gameplay.

In another high-profile tie-up, Krafton India partnered with Mahindra to introduce the Electric Origin SUV BE 6 into BGMI. The integration allowed players to interact with Mahindra’s electric SUV within the game environment, targeting India’s young, tech-savvy demographic through immersive brand storytelling rather than conventional advertising.

“These partnerships are not ads in the traditional sense—they’re experiential placements,” said a digital brand strategist at a global media agency. “Gaming offers something TV or social media can’t: prolonged, voluntary engagement. For brands, that’s incredibly valuable.”

The broader market data supports this shift. According to PwC’s Global Entertainment & Media Outlook 2025–29: India perspective, India’s gaming sector generated $2.7 billion in revenues in 2024, clocking a sharp 43.9% year-on-year growth, compared with 16.8% growth in 2023. While the pace of expansion is expected to moderate, the market is projected to reach $4.0 billion by 2029.

Crucially, PwC notes that while app-based social and casual gaming continues to dominate revenues, in-game and in-app advertising is emerging as the fastest-scaling monetisation engine. In-app and in-game ad revenues are projected to nearly double from $584 million in 2024 to $1.1 billion by 2029, reflecting Indian gamers’ preference for free-to-play models supported by advertising.

The BGMI survey reflects this evolving landscape. Alongside ad-related questions, Krafton is gathering data on esports interest, social features, Indian-themed content, celebrity collaborations, and even hypothetical features for BGMI Lite—suggesting a broader attempt to future-proof product and revenue strategies.

“India is no longer just about selling skins or battle passes,” said another media agency executive. “The next phase is hybrid monetisation—brand integrations, sponsorships, and optional ad experiences layered over core gameplay.”

While Krafton India maintains that no ad monetisation plans are currently under review, the combination of large-scale user research and expanding brand partnerships indicates that BGMI is increasingly being positioned as a premium advertising and engagement platform—one that could redefine how brands connect with India’s rapidly growing gaming audience.

From purpose-driven work and narrative-rich brand films to AI-enabled ideas and creator-led collaborations, the awards reflect the full spectrum of modern creativity.

Read MorePraveen Someshwar, Managing Director and CEO of Diageo India, joins the Grand Jury of the Storyboard18 Awards for Creativity, highlighting the awards’ focus on work that blends cultural relevance with strategic and commercial impact.