Digital

Why OpenAI is hiring 100 ex-bankers: Inside the ChatGPT-maker's secret project to automate Wall Street's grunt work

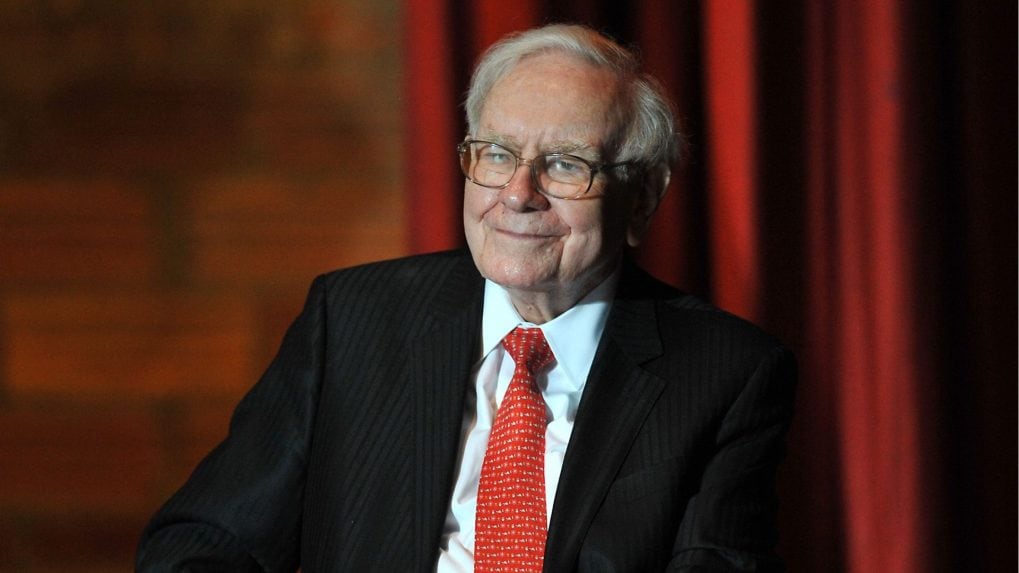

Warren Buffett, often hailed as the Oracle of Omaha, has long been a guiding light for investors worldwide. He bought his first stock at just 11 and even experimented with installing slot machines in local stores during his teens.

Over the decades, he built a reputation as one of the greatest value investors in history, transforming Berkshire Hathaway from a struggling textile firm into a global holding powerhouse. Buffett’s insights continue to shape the way investors think about money, markets, and life.

Here are eight of his most powerful quotes that offer lessons for both investing and living well.

1. "What we learn from history is that people don't learn from history"

Buffett reminds us that humans often repeat the same mistakes, especially in money and investing. Markets crash, trends fail, and yet the same lessons are ignored. By studying history, we can avoid costly errors. While we live in the present, understanding the past gives us an edge in making smarter choices today.

2. "The investor of today does not profit from yesterday’s growth"

Just because a company performed well in the past doesn’t mean it will continue to do so. Buffett highlights that investors must focus on future potential and growth rather than past achievements.

3. "Money is not everything. Make sure you earn a lot before speaking such nonsense"

Financial stability matters. While money is not life’s ultimate goal, being secure gives you freedom to think beyond just earning. Buffett emphasizes that having wealth allows you to pursue greater aspirations and peace of mind.

4. "We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful"

This captures Buffett’s famous contrarian approach. When markets soar and everyone is rushing to buy, he advises caution. Conversely, when panic drives people to sell, opportunities often emerge. True investing requires patience, observation, and courage—not following the crowd.

5. "Only when the tide goes out do you discover who's been swimming naked"

Through this metaphor, Buffett points out that real risk is revealed during hard times. In good times, everyone seems successful, but challenges expose resilience—or the lack of it. Strength and preparedness matter most when conditions worsen.

6. "The most important investment you can make is in yourself"

Buffett consistently stresses personal growth. Learning new skills, improving knowledge, and focusing on health and well-being provide lifelong returns. Unlike stocks or assets, self-investment pays dividends in every aspect of life.

7. "Never depend on a single income. Make an investment to create a second source"

Diversifying income is essential. Relying on one stream is risky, as life is unpredictable. Whether through investments, side hustles, or other ventures, multiple income sources provide long-term security and stability.

8. "No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant"

Buffett reminds us that success cannot be rushed. Consistent effort and patience are essential, while forcing results can backfire. True achievement often requires time to unfold naturally.

Warren Buffett’s wisdom goes far beyond stock markets. His quotes highlight values of patience, discipline, resilience, and self-growth - principles that apply to both investing and everyday life. Whether you’re an aspiring investor or simply seeking guidance for decision-making, Buffett’s timeless words are worth carrying with you.

In a wide-ranging interview with Storyboard18, Sorrell delivers his frankest assessment yet of how the deal will redefine creativity, media, and talent across markets.