Network18’s Reforms Reloaded convenes India’s top minds to discuss the future and impact of GST reforms

Through power-packed panels and exclusive conversations, the forum explored how GST 2.0 can transform industries, empower enterprises, unlock new opportunities, and accelerate Bharat’s rise on the global stage.

ADVERTISEMENT

Network18’s Reforms Reloaded brought together India’s top minds to shape the nation’s next big economic leap. With the next generation of GST reforms taking effect on September 22, 2025, the event convened policymakers, CEOs, economists, tech leaders, defence strategists, and investors to examine the future of GST and chart the path forward for India’s tax and growth agenda.

Through power-packed panels and exclusive conversations, the forum explored how GST 2.0 can transform industries, empower enterprises, unlock new opportunities, and accelerate Bharat’s rise on the global stage. Reforms Reloaded 2025 came at a crucial time, raising vital questions on how India’s policy ambitions can translate into tangible economic impact, how GST 2.0 will ease the cost of doing business and fuel consumption-led growth, and highlighted how India can align its bold reform narrative with on-ground resilience and global credibility.

While GST remained the focal point, discussions extended to broader reform priorities, including divestment, asset monetisation, frontier technologies, defence indigenisation, renewable energy, and India’s evolving role in reshaping globalisation. The day began with CEOs from various sectors sharing valuable insights and market sentiments on the first day of the revised GST implementation.

Highlighting how the government has struck a balanced approach to supporting the economy, combining GST reforms, direct tax relief, and steady public investment, Department of Investment and Public Asset Management (DIPAM) Secretary Arunish Chawla said, “Public investment through budgetary support has remained on target, with 33% of the year's goal achieved by the end of July.” He also highlighted the democratisation of capital markets as a major reform, noting that despite recent nervousness, two-thirds of domestic institutional investors (DIIs) are individual investors. From January to August, while foreign institutional investors (FIIs) pulled out Rs 1 lakh crore in net terms, DIIs invested Rs 5 lakh crore.

“As markets stabilise, we will bring in more OFS (offer-for-sale), minority stake sales, a few IPOs and speed up the journey," Chawla said, adding that the government is confident of exceeding the divestment target of Rs 47,000 crore this year. “We are in a phase of growth convergence," he added, urging against an obsession with headline figures. “If we can grow relative to global growth, we should be thrilled.”

Further, talking about the latest GST reforms, the Chief Economic Advisor V Anantha Nageswaran said, “The GST 2.0 is a very significant landmark reform. I am very confident that it will provide a very significant boost to domestic demand. Coming on top to the indirect taxes are the concessions and relief announced as part of the Union Budget. Taking a multiplier effect, these will quite definitely boost the GDP numbers," he said.

“India's FY26 GDP growth will tend towards the upper end of 6.3-6.8 per cent range in FY26, following the GST 2.0 reforms, " he added.

Moving forward, speaking on how GST 2.0 will touch lives across all sections of society, Shri Gajendra Singh Shekhawat, Union Minister of Tourism, said, “The next-generation GST reforms, effective from today, will help everyone from a farmer to a 'millionaire' in Mumbai. About 95 per cent of goods will see a reduction in taxes. This will help people have more money in their pockets, which will boost consumption…and tourism in one important aspect of it".

"Earlier, only a few were taking the burden of paying taxes. Now, we have a huge cohort of people who pay taxes in small or large amounts. The 2.0 reforms will benefit MSMEs and the manufacturing sector," said Shekhawat.

Broadening the discussion, Rajesh Kumar Singh, Defence Secretary of India, underlined the government’s commitment to indigenisation in the defence sector and said, “We will have $25–30 billion of capex every year in defence over the next decade. Our current plans are that at least 75% of capex would be spent within the country.”

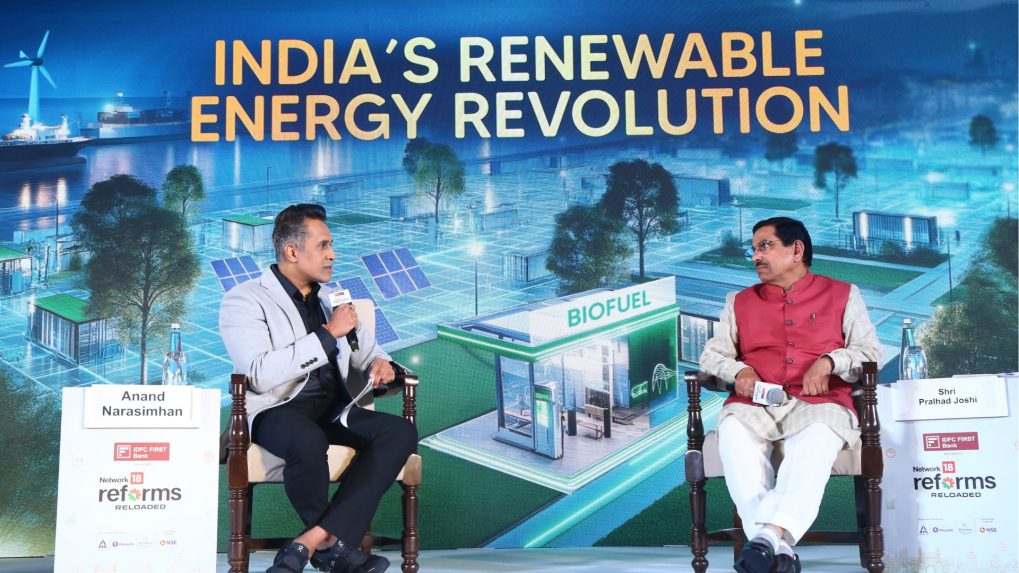

Hailing GST 2.0 as the biggest reform since 1975, Shri Pralhad Joshi, Minister of Consumer Affairs, Food & Public Distribution, Government of India, mentioned that his ministry has set up a dedicated helpline to address consumer complaints on GST benefits not being passed on, and has also created a mechanism to resolve such disputes pre-litigation.

“This is above the necessary steps taken by the finance ministry. Compliances have been simplified, refunds have been made online for input credit… what can be a bigger relief for businesses than this? People are very happy about it. It is the biggest relief for the public,” Joshi said.

At Network18’s Reforms Reloaded, the country’s most influential voices discussed, decoded, and deliberated on the revised reforms, their impact on both end consumers and conglomerates. The meaningful dialogues underscored optimism about India’s reform trajectory, highlighting the potential of GST 2.0 to drive a more competitive, consumption-led economy by boosting domestic demand, strengthening GDP growth, and enhancing India’s overall economic competitiveness.