Ad holdcos brace for new pressure as India’s power order resets: WPP, Omnicom+IPG, Publicis

The merger instantly reshuffles India’s agency rankings, pushing the combined Omnicom–IPG entity ahead of Publicis and intensifying pressure on market leader WPP to defend share, accelerate AI bets, and fight harder for talent and new business.

ADVERTISEMENT

The completion of Omnicom Group’s acquisition of Interpublic Group (IPG) on Nov. 26, 2025 is not just a headline-making transaction in New York, it immediately reorders competitive dynamics in India, where scale, exportable services and data/tech capabilities determine who wins the biggest media mandates and global briefs.

The new Omnicom (pro-forma revenues above $25 billion) now leads the list of global holding companies and brings together creative, media and data assets under one roof; that alone changes how global clients and Indian advertisers evaluate their agency rosters.

The arithmetic that matters in India

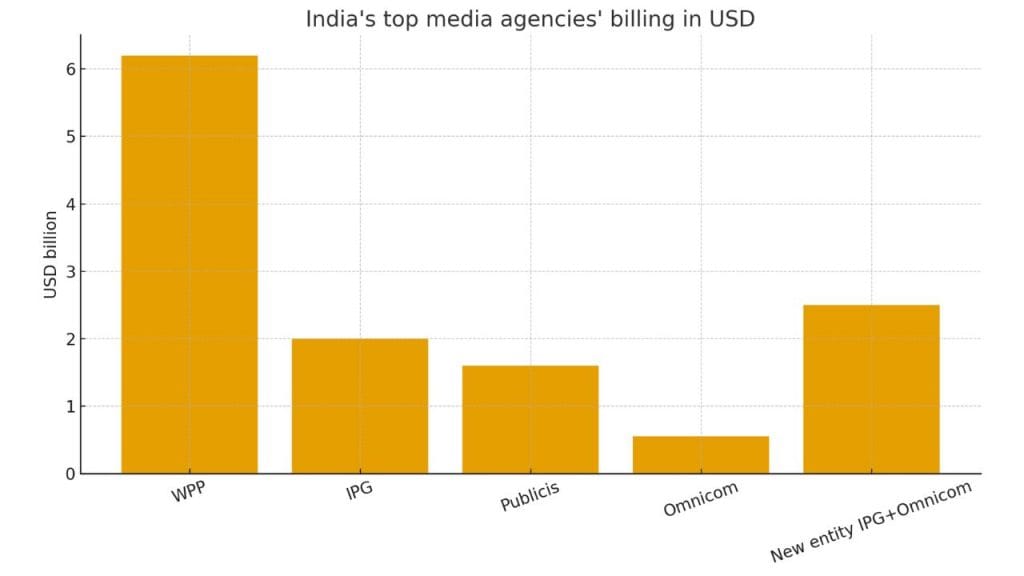

India’s market map was already top-heavy: WPP Media (GroupM + WPP's media assets) topped COMvergence’s 2024 billings with roughly $6.6 billion, followed by IPG Mediabrands at ~$2.0bn and Publicis Media at ~$1.7bn.

Omnicom’s India billings had been substantially smaller (industry estimates put OMD/PHD/OMG at roughly $500–600m), meaning the combined Omnicom–IPG now commands roughly $2.4–2.6bn in India, comfortably the country’s new No.2 media-buying group behind WPP but still some distance from the leader.

That re-ranking is the immediate, measurable shift: a second-place combine with clearer negotiating heft for national TV/inventory and global pitch leverage.

What this means for WPP in India — defend, invest, and double-down on tech

The global revenues in the recent quarters plunged as the company faced client losses and a deteriorating media business in the West. Revenue less pass-through costs fell 5.9% on a like-for-like basis to £2.46 billion, prompting a downgrade of full-year guidance to a decline between -5.5% and -6.0%. But India stood out as the only major market to record positive growth, clocking 6.7% like-for-like growth in Q3- a rare highlight amid declines of 5.6% in the US, 8.9% in the UK, and over 10% in Germany and China.

End of the Old Guard? Publicis outperforms, WPP declines, Havas rises, Omnicom acquires IPG

WPP’s lead in India is sizable and structural: scale across mass-media buying (Mindshare, Wavemaker, Essence) gives it superior local bargaining power and a dense client roster. But the Omnicom–IPG combination presents two stressors for WPP:

• Pricing and inventory negotiation. A larger second player changes supply-side dynamics and could pressure CPMs or force new volume-based commercial models for broadcasters and digital platforms.

• Talent and new-business pressure. Consolidation creates combined global teams that can pitch multi-market deals with a local delivery hub, increasing competition for senior client leads and new-business wins in India.

WPP’s clear counter-move has been investment into AI and partnerships (for example its recent multi-year Google tie-ups and internal tooling) to offer differentiated data-driven services beyond pure buying power, a strategy aimed at making scale less relevant than capability. One can expect WPP to accelerate productised AI offerings, data partnerships, and M&A in India focused on martech and measurement.

The group’s new CEO Cindy Rose, although described the company’s performance as “unacceptable”, but reiterated that its turnaround would be anchored in emerging markets, AI integration, and simplification of operations.

Publicis: niche advantage — tech first, scale second

Publicis, which sits behind the new Omnicom–IPG combine in India but ahead of many independents, has long pushed tech-led positioning (Sapient, Epsilon and other martech bets globally). Its ~$1.6–1.7bn India billings place it as a clear top-three player.

In Q3 2025, the company recorded 5.7% organic growth, ahead of expectations. Chairman and CEO Arthur Sadoun recently said the group’s AI integration “is not a future promise, it is a reality today that is driving our growth.”

On the back of this performance, it upgraded its full-year outlook (organic growth between 5.0–5.5%) and expects operating margin to remain comfortably high across its global business. Meanwhile, the group’s Global Capability Centres (GCCs) in India, employing 10,000+ people (nearly half of its global workforce), have transitioned from back-end service providers to revenue-generating units.

Naturally, the new market reality will push Publicis to double down on what worked: productised data platforms, case studies that sell efficiency + growth, and cross-sell of creative + commerce solutions to Indian CPG and retail clients that prize performance and measurement.

The Groupe will enter 2026 with momentum, a premium-tech positioning, and a growing India base, well placed to defend against the new Omnicom–IPG competition.

Havas - smaller footprint but strategic optionality

Havas is a distinctly smaller global and Indian player by scale compared with the three above, but its 2024 results show organic growth and a strategy of “being deliberately different” : nimble, targeted acquisitions and vertical specialisation (health, tech).

Havas’ global net revenue (FY24) crossed €2.7bn, and while it doesn’t rival WPP or Publicis in India billings, it can play a role in potential consolidation, either as a buyer of specialist boutiques or, in theory, as a partner for parts of other groups.

That said, recent reporting shows Havas publicly denying that it is in talks with WPP about a deal even as market chatter circulates; so any WPP–Havas tie up remains speculative and unconfirmed.

India among bright spots as Havas posts steady growth in first half of 2025

Havas posted 3.8% organic growth in Q3 2025, supported by its “Converged.AI”-led offerings and growth in its healthcare vertical. The company raised its full-year growth guidance to 2.5–3.0%, with EBIT margin of around 12.9%. Regionally, Asia-Pacific and Africa saw an 8.2% rebound after a sluggish first half — with India among the better-performing markets according to Havas’s internal disclosures.

In a nutshell, Havas may be smaller in scale, but its steady growth, AI-first positioning and agility give it a stable niche. Its health-sector strength and diversified global footprint could make it an attractive consolidation target or a reliable “safe harbour” for clients avoiding mega-group volatility.

Omnicom+IPG (pro-forma)

Ahead of merger close, Q3 2025 results for Omnicom Group showed 4% overall revenue growth ($4.04 billion), though net income dropped ~11.6%, partly due to acquisition-related costs. Its core “Connected Media” division, driven by data arm grew at a high single-digit pace; "Intelligent Creativity" and “Technology” units posted mid- to low-single-digit growth despite softness in IT consulting demand.

Omnicom–IPG deal: India leaders to watch

Although IPG has reduced its global workforce by 3,200 employees, or just over 5%, since January 2025, for the third quarter it reported a 5.1% year-on-year (YoY) decline in revenue, even as profits improved due to cost savings and operational streamlining. Consolidated organic revenue fell 2.9% YoY, driven primarily by net client losses in the retail, automotive, and transportation sectors, along with reduced spending from existing clients.

Despite top-line pressure, IPG reported new business wins and client growth in the food & beverage, healthcare, financial services, and technology & telecom sectors. Notably, in late September, IPG was selected as the global agency partner (creative, production, and media) for Bayer’s Consumer Health division, underscoring its continued strength in integrated marketing capabilities.

The ongoing headcount reduction forms part of a larger restructuring initiative that CEO Philippe Krakowsky first outlined during the company’s February 2025 investor call. At the time, Krakowsky said the reorganization was expected to generate $250 million in savings in 2025, independent of the $750 million in synergies projected from the upcoming merger with Omnicom. Omnicom itself has been tightening operations, having cut 3,000 jobs in 2024, leaving it with 74,900 employees at year-end. In its Q3 earnings call, Omnicom CEO John Wren said the company plans to unveil its post-merger structure and portfolio strategy during CES in January 2026.

IPG cuts 3,200 jobs as of September 2025 ahead of Omnicom takeover

For the newly merged entity in India, this expanded capabilities: scale, data + media + creative stack, combine with global resourcing. India (and SEA) now sit not just as cost factories, but as growth and delivery hubs.

Omnicom+IPG is not just a global power, but contended to be a serious challenger in India’s big leagues too. With a combined media-buying and data/tech/creative stack, it emerges as the No. 2 buying entity, and could begin aggressively pitching large multinational accounts, clients who value global integration and scale.

WPP–Havas tie-up: speculative but persistent

Post-merger speculation around potential tie-ups didn’t die with the Omnicom–IPG closure. Market chatter suggests a possible alliance or acquisition involving WPP and Havas, though as of now: officially, there is no active negotiation. Given Havas’s growth trajectory, AI-first approach and stable profitability, a WPP-Havas deal, while not imminent, cannot be dismissed. If it happens, it could re-consolidate the so-called “middle tier” of global holdcos and reshape markets from India to Europe again.