Online Gaming Bill: RMG ban sparks offshore betting ad blitz; discounts and dubious celebrity ads

For years, India’s domestic real-money gaming sector—which included large players in fantasy sports and skill-based contests—argued that they provided a safer and regulated alternative to offshore betting platforms.

ADVERTISEMENT

India’s sweeping ban on real-money gaming has triggered unintended consequences: offshore gambling and betting operators are showering Indian users with aggressive promotions and discounts. Industry insiders say the crackdown has effectively handed the market over to illegal firms who have long operated in the shadows.

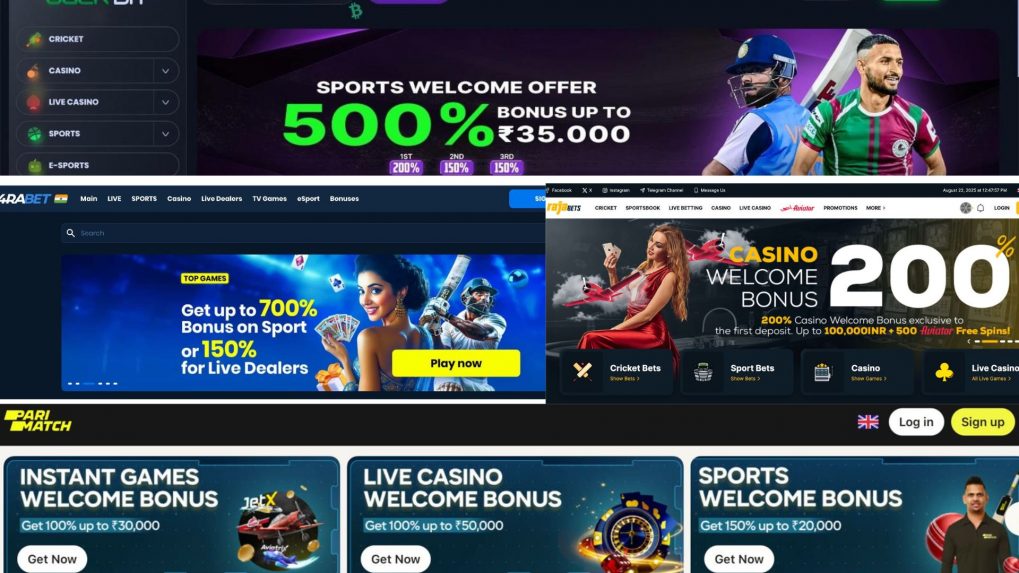

In the days following the ban, platforms such as JackBit, 1xBet, Parimatch, Odds96, and 4RaBet have unleashed a blitz of digital marketing campaigns targeting Indian users. The offers are staggering by any standard—JackBit rolled out a 500 percent bonus on deposits as low as ₹35, while 1xBet dangled a 120 percent first-deposit bonus of up to ₹33,000.

Parimatch is promoting 100–150 percent discounts, Odds96 is giving away ₹150 in free credits just for signing up, and 4RaBet has gone further, offering a massive 700 percent discount on its portfolio of games, including chance-based titles such as Aviator, JetX, Chicken Road, and Astronaut.

At the same time, fake AI-generated celebrity endorsements continue to surface across social media platforms, featuring prominent Indian film stars and sports icons urging users to sign up. These fabricated ads—slickly produced and difficult for average users to identify as fraudulent—lend an air of legitimacy to offshore betting platforms that remain outside India’s regulatory and tax net.

Read More: We never saw it coming: Shock, anger and heartbreak in the gaming industry

A senior executive at a now-shuttered Indian real-money gaming company did not mince words. “The offshore betting and gambling companies are celebrating the demise of legitimate Indian gaming firms who always opposed them. They do not pay any taxes, they pump heavy money into digital platforms to lure Indians, and now with domestic operators gone, there’s no real competition left. This was bound to happen,” he said.

Industry insiders argue that the government’s decision has created the very scenario Indian regulators claimed they wanted to avoid: driving users toward unregulated, offshore platforms that pose greater financial and social risks.

“The government is not capable of tackling the menace of illegal gambling platforms. Instead, it has axed the legitimate skill gaming companies who paid taxes and generated revenues for the state,” said another founder. “This is a classic case of punishing the compliant while rewarding the illegal.”

For years, India’s domestic real-money gaming sector—which included large players in fantasy sports and skill-based contests—argued that they provided a safer and regulated skill based games unlike offshore betting platforms which are completely chance based. Legitimate RMG firms operated under taxation frameworks, employed lakhs of people, and contributed significantly to government revenues. According to industry estimates, the sector generated around 2 Lakh jobs and contributed thousands of crores in taxes annually.

Read More: 'Still in shock': Co-founders speak out on India's new Online Gaming Bill 2025

Industry bodies had raised red flags well before the law was enacted. The All India Gaming Federation (AIGF), Federation of Indian Fantasy Sports (FIFS), and E-Gaming Federation (EGF) jointly wrote to the Home Minister earlier this year, cautioning that an outright ban would not eliminate demand but would instead push users toward illegal markets. “The demand for real-money gaming is not going to vanish overnight,” one official noted at the time. “If you shut down compliant companies, users will simply migrate to platforms that operate outside the law, beyond the reach of Indian regulators.”

That prediction now appears to be playing out in real time. Search results, social media ads, and influencer-driven campaigns are increasingly dominated by offshore betting companies, many of whom are exploiting the sudden absence of domestic competition.

Analysts say this not only poses risks of money laundering and tax evasion but also leaves Indian users vulnerable to fraud and exploitation, with no legal recourse in case of disputes.

Meanwhile, the celebratory tone of offshore operators is unmistakable. Digital campaigns from companies like JackBit and 4RaBet highlight their massive offers as “welcome gifts” to Indian players—messaging that industry observers interpret as direct gloating over the downfall of legitimate rivals.

The irony, insiders note, is hard to miss. By shutting down India’s homegrown, tax-paying gaming sector, the government has inadvertently turbocharged the very black-market operators it once sought to curb. And unless there is a serious crackdown on offshore betting platforms, the celebration in these circles is likely to continue.

Read More: Dream11 exits as team India sponsor after Online Gaming Bill, BCCI looks for replacement