Alphabet Q1 2025: Google's ad revenue growth slows, hits $66.89 billion in the quarter

Revenue from Google’s core advertising business rose 8.5 percent to $66.89 billion, a deceleration from the 10.6 percent growth reported in the previous quarter.

ADVERTISEMENT

Alphabet, the parent company of Google, reported robust first-quarter earnings, buoyed by strong demand for its core advertising services and fast-growing cloud and artificial intelligence businesses.

Read more: Google crosses 270 million paid users; posts strong quarter as AI innovation drives

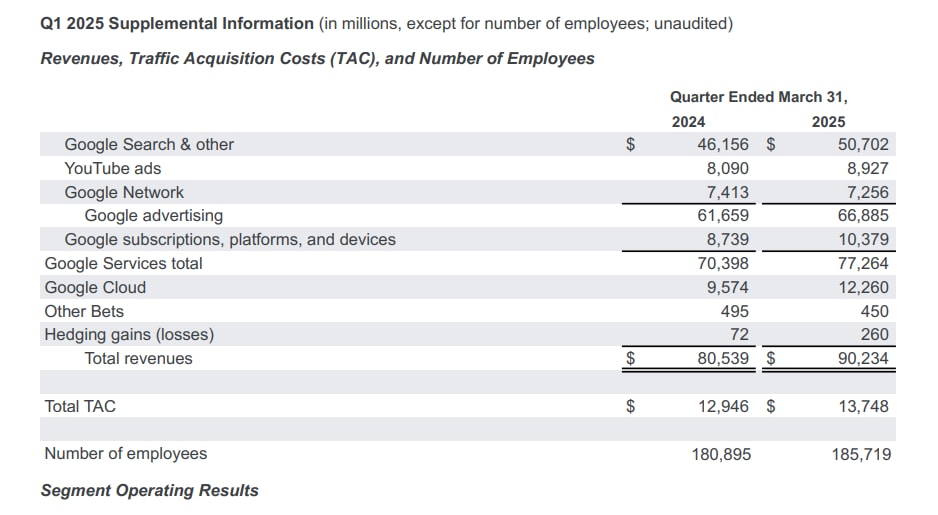

The tech giant said revenue rose 12 percent from the same period a year earlier to $90.2 billion, or 14 percent in constant currency. Net income surged 46 percent to $23.7 billion, as Alphabet expanded its operating margin to 34 percent.

“This quarter was super exciting,” Sundar Pichai, Alphabet’s chief executive, said in a statement. “We’re seeing breakthroughs in performance from our AI investments, and that momentum is translating into growth across the board.”

Much of the quarter’s strength came from Alphabet’s core Google Services segment, which includes search, YouTube, and the company’s growing portfolio of subscription offerings. Revenues from the unit climbed 10 percent to $77.3 billion, highlighting the strength of Google’s advertising engine and growing demand for paid services like YouTube Premium and Google One. The company now counts over 270 million paid subscriptions across its platforms.

Revenue from Google’s core advertising business, which accounts for nearly three-quarters of the company’s total sales, rose 8.5 percent to $66.89 billion - a deceleration from the 10.6 percent growth reported in the previous quarter.

Search advertising generated $50.7 billion in sales.

Google’s video-streaming site YouTube, which turned 20 years old in February, posted $8.92 billion in revenue. YouTube, which has made a significant foray into podcasting, now draws over a billion monthly viewers for podcast content — surpassing competitors like Spotify and Apple in the space. While advertising remains its primary revenue driver, executives noted on the earnings call that YouTube also saw continued growth in paid subscriptions.

Google Cloud, a business that has historically lagged rivals like Amazon Web Services and Microsoft Azure, continued its upward trajectory with revenues jumping 28 percent to $12.3 billion. Executives pointed to increased adoption of core infrastructure products and surging interest in generative AI tools built on Google’s latest model, Gemini 2.5.

Pichai highlighted growing engagement with Search, crediting AI-powered features such as AI Overviews, now used by 1.5 billion people each month. “Our full stack AI approach is proving to be a key differentiator,” he said.