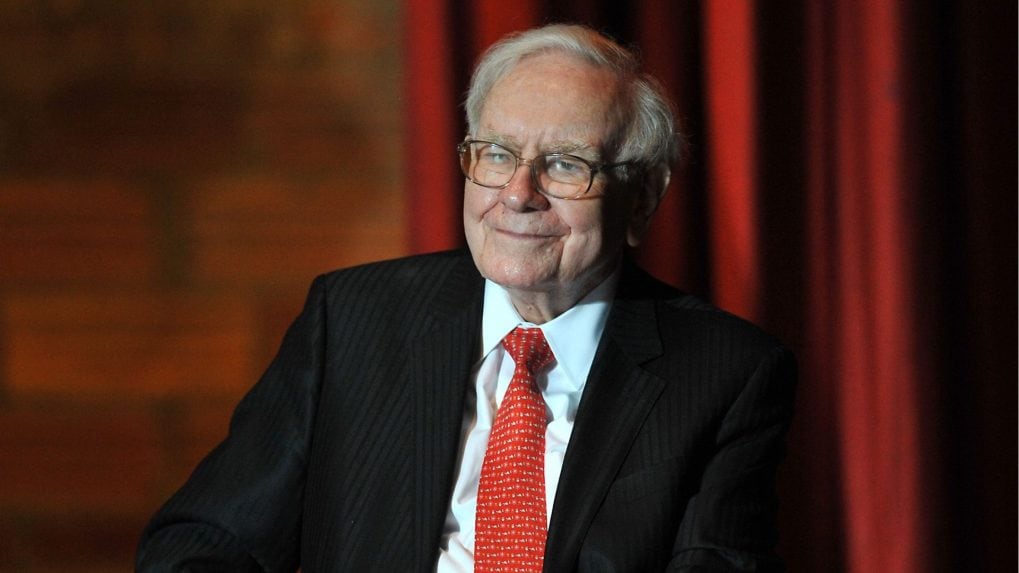

Two decades after inspiring Google’s IPO, Warren Buffett makes rare bet on Alphabet

Buffett stated in 2017 that he regretted not purchasing Google shares much earlier, noting that Berkshire’s insurance arm Geico had been spending heavily on advertising through Google for years.

ADVERTISEMENT

More than twenty years after Google’s founders publicly acknowledged Warren Buffett as an inspiration for their IPO philosophy, the billionaire investor has finally placed a major bet on the company he once admired from afar. In Google’s 2004 IPO prospectus, Larry Page and Sergey Brin titled their founders’ letter An Owner’s Manual for Google’s Shareholders and stated in a footnote that the document was heavily influenced by Buffett’s writings, particularly his Berkshire Hathaway shareholder essays and his own Owner’s Manual.

Two decades on, Berkshire Hathaway has returned the compliment, as reported by CNBC. The conglomerate disclosed late on Friday that it held around $4.3 billion worth of shares in Alphabet at the end of the third quarter, a position that now ranks as Berkshire’s tenth-largest equity holding. The move represents one of Berkshire’s most substantial technology investments since its large commitment to Apple, and it prompted a 3% rise in Alphabet’s share price on Monday.

It is an unusually bold shift for Berkshire, which has historically been wary of high-growth technology stocks, and it marks the first known instance of the firm taking a position in Google’s parent company. Buffett, now 95, is due to step down as chief executive at the end of this year, with long-standing deputy Greg Abel preparing to assume leadership.

Buffett stated in 2017 that he regretted not purchasing Google shares much earlier, noting that Berkshire’s insurance arm Geico had been spending heavily on advertising through Google for years. He also admitted to missing the early opportunity in Amazon, a company Berkshire eventually bought into in 2019 and in which it still holds a stake worth $2.2 billion.

Alphabet’s shares have risen 50% this year, boosted further by Monday’s increase, and are trading just below the record high reached last week. The company recently reported its first-ever $100 billion revenue quarter, driven by gains in its cloud business, which includes its artificial intelligence services. Alphabet’s cloud division has also accumulated a $155 billion customer backlog and unveiled a refreshed range of AI chips that differentiates it from rivals.

Despite its growth, Alphabet’s valuation sits below that of several major AI-focused peers. The stock trades at roughly 26 times expected earnings for next year, compared with multiples of 32 for Microsoft, 51 for Broadcom and 42 for Nvidia, according to FactSet.

Page and Brin now rank seventh and eighth on the Forbes billionaires list, just behind Buffett in sixth position. Their admiration for the investor was evident throughout the Google IPO prospectus, where they cited his philosophy multiple times. They stated that firms often face pressure to massage short-term results at the expense of long-term objectives and noted Buffett’s stance that earnings should not be artificially smoothed for market expectations.

In defending their dual-class share structure, which granted them disproportionate voting control, they informed prospective investors that Berkshire Hathaway had previously adopted a similar model. They also referenced media companies such as The New York Times, the Washington Post and Dow Jones as examples of organisations that used such structures to maintain editorial independence and pursue long-term goals.