Britannia reports modest profit growth amid challenging market conditions

"The performance underscores our resilience in a challenging operating environment marked by rising commodity prices, changing channel dynamics, and subdued demand across FMCG categories,” Varun Berry said in a statement.

ADVERTISEMENT

Britannia Industries reported consolidated sales of ₹4,376 crore for the quarter ended March 31, 2025, reflecting a 9 percent increase over the same period last year. Net profit for the quarter rose 4 percent year-over-year to ₹559 crore.

Read more: Britannia's Varun Berry named CEO in addition to his current role as Exec VC and MD

For the full fiscal year, the company posted consolidated sales of ₹17,535 crore, marking a 6 percent rise, while annual net profit edged up 2 percent to ₹2,178 crore.

Varun Berry, Vice Chairman and Managing Director of Britannia, attributed the quarterly performance to the company’s strategic pricing decisions and operational efficiencies, even as the broader consumer goods sector grappled with inflationary pressures and muted demand.

“With a high single-digit value growth of 9 percent during the last quarter of the year amidst a tight consumption scenario, the performance underscores our resilience in a challenging operating environment marked by rising commodity prices, changing channel dynamics, and subdued demand across FMCG categories,” Berry said in a statement.

Britannia said it achieved cost savings amounting to approximately 3 percent of revenue through various efficiency initiatives. The company also expanded its direct distribution network, now reaching 2.9 million retail outlets across India, with a particular emphasis on rural market penetration.

New product launches—including a premium line of Pure Magic Choco Frames and an expanded Winkin’ Cow portfolio, were credited with bolstering adjacent business segments. The company also continued promotional investments in its legacy brands, such as Marie Gold and Good Day.

Looking ahead, Berry said Britannia would maintain a cautious stance on commodity price movements while pursuing “healthy, profitable growth” and reinforcing its leadership position in the market.

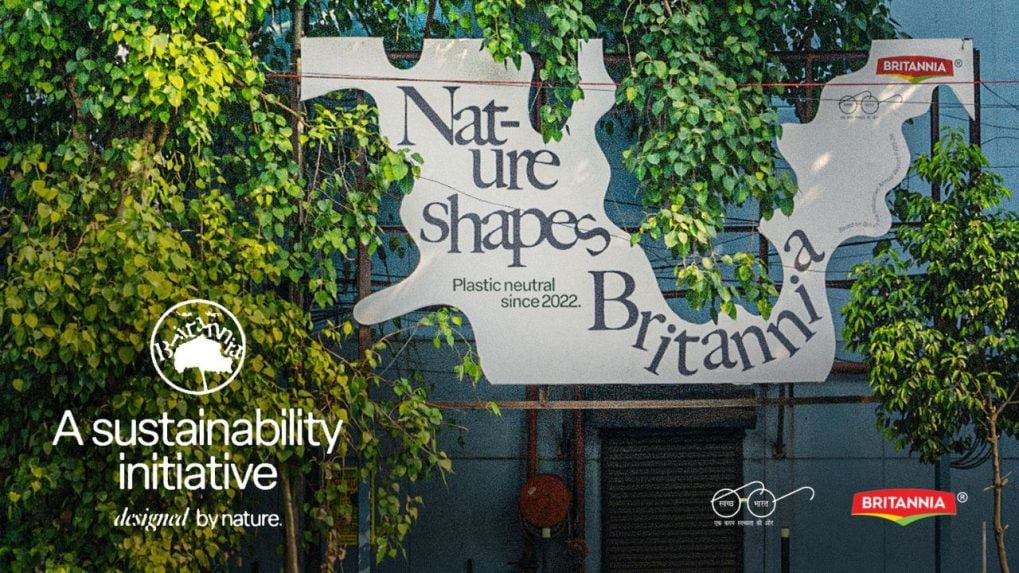

He said the company’s commitment to its environmental, social and governance (ESG) priorities, stating that Britannia would “continue to focus on our initiatives to build a sustainable and profitable business.”