Why is Bollywood failing to take off despite the marketing blitz?

Bollywood has spent close to Rs500 crore on marketing films this year but none of it has helped ticket sales pick up at the box office. Experts blame content.

ADVERTISEMENT

Another Bollywood release bites the dust. Tall promises, umpteen promotions, real life wedding of the star cast and still Brahmastra couldn’t manage to bring in the expected moolah.

Hundreds of crores are being spent on marketing Bollywood movies with actors performing hook steps, singing songs, creating memes, collaborating with influencers and travelling around the world talking about their movies.

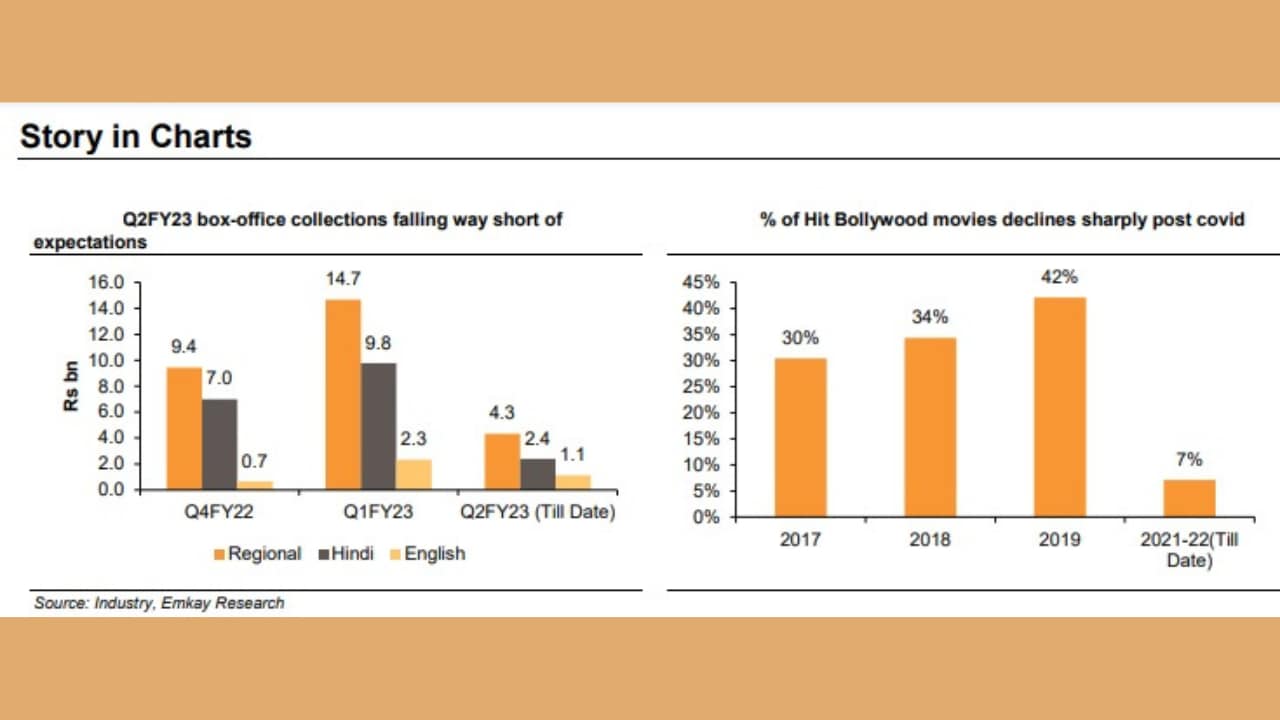

Still, most of 2022 releases failed to leave a mark at the box office. Analysis by Emkay Research says, Q2 FY23 box-office collections are falling way short of expectations. The quarter has clocked close to Rs 2.4 billion till date, against Rs 9.8 billion in Q1.

Covid-19 is no longer the reason because Hollywood releases as well as Indian regional cinema have been performing exceptionally at the box office. Films like KGF and RRR made close to Rs1000 crore each from theatrical release only. So what is missing? Experts said it's nothing but good content.

Data on box office collections by Emkay Research

All show but no go

“Marketing alone can never sell a movie. In fact, the amount of marketing being done is actually a waste of resources. 'Liger' is the most recent example. Content is still the king and star cast or good marketing cannot make up for the lack of good content,” says film trade analyst Atul Mohan.

The makers of Liger, for instance, roped in all top digital influencers to create original content for the star cast. Popular creators like Niharika Nm and Neethu Nair were on-boarded for the same and none of these content pieces garnered any less than 25 lakh likes and millions of views. The film, however, didn’t even make it past the Rs50 crore mark at the box office.

“Word of mouth makes a movie popular and that happens only when the audience likes a movie. Promotions can take the people to the theatres in the first weekend. For the growth to sustain, the movie needs to do well beyond the first Friday-Saturday-Sunday. Only good content can make that happen,” adds Mohan.

According to him close to Rs500 crore has already been spent this year on marketing initiatives by the Hindi film industry.

Analysis by business insiders corroborates the observation of marketing experts.

Naval Seth, deputy head of research at Emkay Global Financial Services, in his report says "Sub-par content quality is being rejected by the audience.”

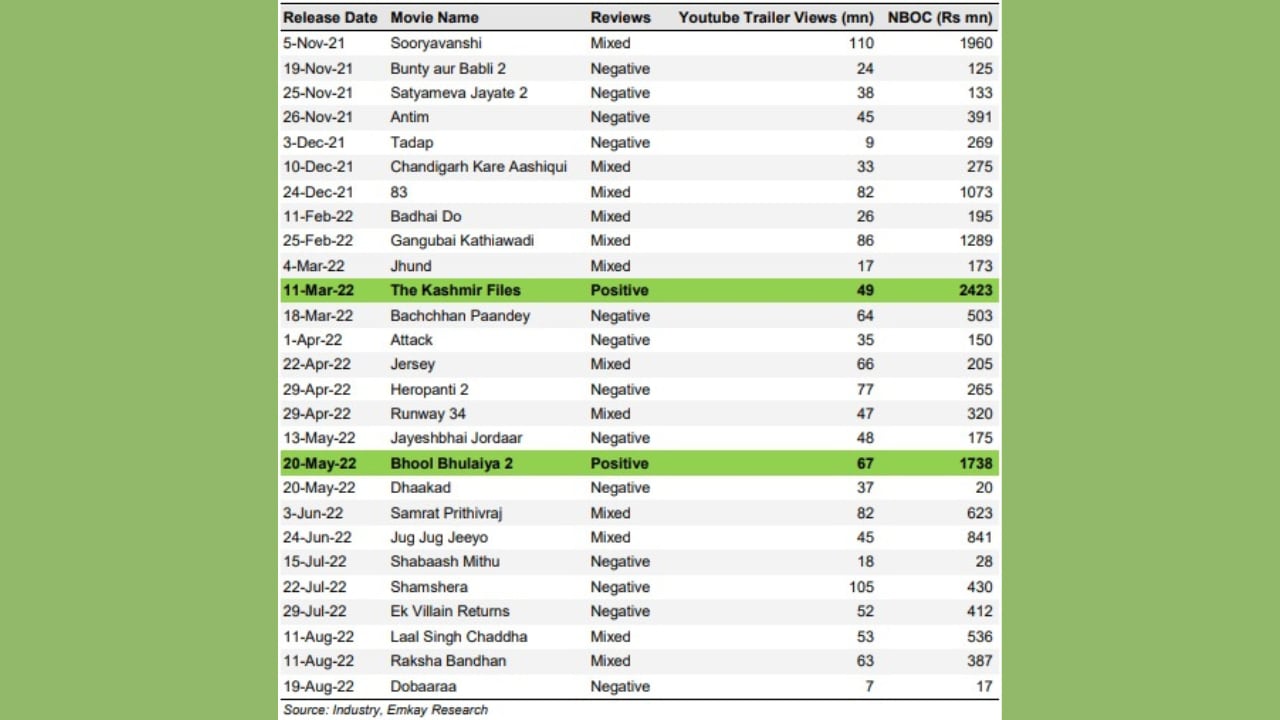

Poor content is pushing the audiences to switch to other languages and mediums of entertainment, according to the report. It further says, “Critics reviews and word-of-mouth communication, which play a major role in box-office collections beyond the first week, have been negative-to-mixed for most movies released since the end of the pandemic. Thus, most movies have even struggled to recover the cost. A mega-star cast, which was able to pull audiences to theatres, is now no longer effective as weak content has become the decisive factor. The first weekend net box-office collections for movies with prominent stars are getting restricted to less than Rs400 million now vs pre-Covid levels of Rs1,100 million on an average.”

Evidently, this is why analysts are calling Brahmastra a disappointment even after clocking box office collections to the tune of Rs160 crore in the first week.

The second week hardly has a chance to make enough money given the poor content reviews, experts said. Clearly even touching the Rs200 crore mark is not enough for a film budgeted at Rs450 crore where close to Rs40 crore was spent on promotions only.

Ticket pricing and demand-supply gap

The same research from Emkay, also points out that most current and potential movie releases in the next few quarters were conceptualized pre-Covid or during the Covid period.

Gauging consumer behavior, consumption habits seem to have changed and content needs to evolve accordingly, to pull them back to theatres.

Additionally, the inflationary scenario has raised the cost of movie-going, which has increased content-quality filtration by patrons.

Basically, pricing is another issue that has been keeping moviegoers away from the cinema screens when it comes to Bollywood releases. Misplaced implementation of the 4Ps of marketing is a big reason behind the failure of box office performance of these releases. There is less focus on product and pricing, said experts.

“Either you answer the question of why one should pay for the ticket they are buying at the theaters through a fantastic product or you make sure pricing matches the run of the mill product you are selling,” said Rachana Monteiro, SVP, Starcom.

If the pandemic has done anything, it has increased the consumer expectation of quality content, according to Monteiro. “From the demand perspective expectations have gone up and from the supply perspective content quality from Hindi films have only fallen,” she adds.

Southern films vs Hindi films

The success of southern films offers a lesson or two for Bollywood, says Kumar Awanish, Chief Growth Officer, Cheil India.

“They (Southern films) have perfected the art of knowing what a viewer across India wants. Their films resonate with audiences beyond the local geographies. Hindi films are often dubbed to be elitist and have alienated the big screen watching audience of the hinterlands,” Kumar Awanish, Chief Growth Officer, Cheil India.

As the pandemic receded a lot of films from South have hit the big screen dubbed in multiple languages enabling them to gain traction across India.

However, Bollywood’s only hope to make up for money lost at the theatres was the OTT release.

“Let’s wait for a month and watch it on OTT- this is the idea that has killed most of Bollywood’s box office business,” says Monteiro. According to her the availability of world class content OTT has made the people very choosy about what they want to watch at the theatres.

Highlight on reviews, views and Net Box Office Collections (NBOC) by Emkay Research

How can Bollywood bounce back?

Good content is the only solution, experts citing examples of the two successful Bollywood box office hits of the year- The Kashmir Files and Bhool Bhulaiya 2.

Innovative marketing can also be of help, says Awanish.

“Marketing is an important tool to ensure that audiences are back post pandemic hiatus. Unlike Hollywood, where big studios put their entire heft behind the marketing of a film, Bollywood has to go creative if it has to grab attention of the viewers who are still dragging their feet to the theatres,” he tells Storyboard18.

According to him, Netflix offers a plethora of lessons especially the way they share their social media content.

“Their content is highly engaging and apt which, speaks the language that touches the pulse of the viewers. Trailers and promotions done by these production houses spotlight the key scenes with a purported objective of leaving audiences on a cliff hanger,” he adds.

Hindi cinema will need more than money, influencers and marketing tricks to keep drawing audiences to theatres and not let the streamers eat away at their pie. The right content at the right price should help Bollywood battle its blues.

This is not the end though. As they say, 'picture abhi baaki hai'.