IPO-bound Groww allocates Rs 225 crore for brand-building, Rs 205 crore on subsidiaries

Groww IPO: The largest share of the net proceeds, that is Rs 225 crore, will go towards brand building and performance marketing, followed by Rs 205 crore to its material subsidiaries.

ADVERTISEMENT

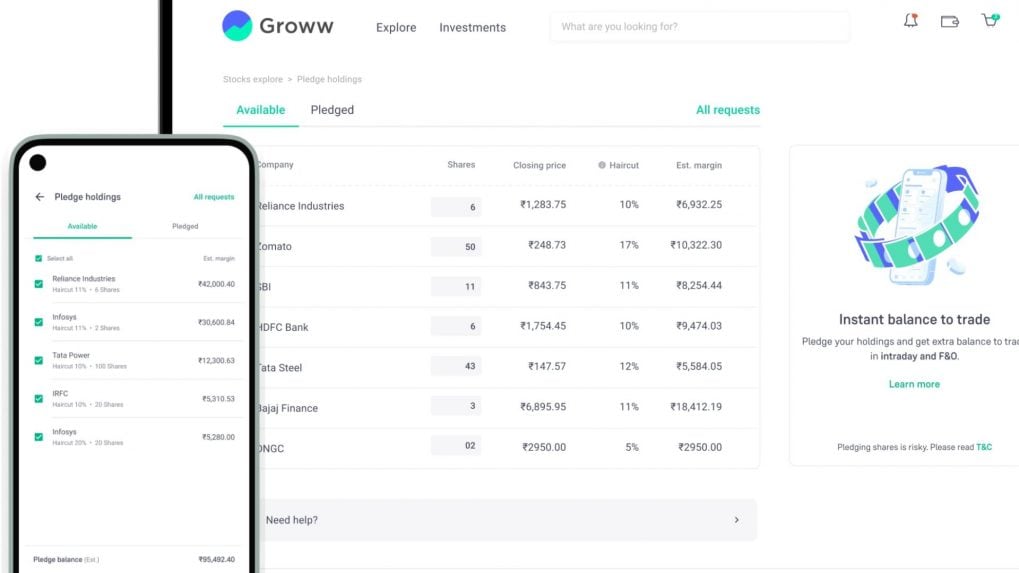

Groww has filed an updated draft red herring prospectus with the Securities and Exchange Board of India (Sebi). The online stock trading platform will be issuing fresh shares worth Rs 1,060 crore and an offer for sale of 57.42 crore shares by existing investors and shareholders.

As per the IPO documents filed by Groww’s parent, Billionbrains Garage Ventures Limited, the largest share of the net proceeds, that is Rs 225 crore, will go towards brand building and performance marketing, followed by Rs 205 crore to its material subsidiary, Groww Creditserv Technology Private Limited, Rs 167.5 crore to Groww Invest Tech Private Limited, and Rs 152.5 crore for strengthening cloud infrastructure.

Of the Rs 225 crore earmarked for brand building, Groww plans to deploy Rs 135 crore towards performance marketing, including digital advertising, and Rs 90 crore for traditional channels such as television, print, radio, and on-ground campaigns. The company has further outlined spends of Rs 45 crore in FY26 and Rs 90 crore in FY27 on performance marketing, alongside Rs 30 crore in FY26 and Rs 60 crore in FY27 on traditional marketing.

Satya Nadella-backed Groww becomes first Indian startup to return from U.S. and go public

"We define marketing and business promotion expenses as our Cost to Grow," the company mentioned in its DRHP.

Notably, the Bengaluru-headquartered firm has significantly scaled up its marketing and business promotion expenses since the fiscal year ended on 31 March 2023. According to the DRHP document, Groww's brand-building spends have surged from Rs 243.8 crore in FY23 to Rs 487.5 crore in FY2025. The marketing expenses accounted for 30.54% of the total expenditure of Rs 1,596.4 crore in FY25.

During the first quarter of fiscal year 2026 (Q1 FY26), Groww spent Rs 108.4 crore on marketing and business promotions.

However, the discount broker's branding expenses have declined as a percentage of total income between FY23 (19.34%) to FY25 (12%). This is because of the organic growth in the customer base over the years.

Groww co-founders bag multi-crore pay packages in FY25; Attrition hits 50% in support teams

Besides, the marketing and business promotion expenses as a percentage of revenue from operations declined from 21.36% in FY23 to 17.20% in FY24, 12.50% in FY25, and 18.21% in the three months ended June 30, 2024, to 11.99% in the three months ended June 30, 2025.

"We invest in marketing and branding expenses to drive new customers to use our platform and to encourage existing customers to increase their wallet share with us. We believe our business is relationship-driven rather than a transactional one. This approach has encouraged investors to join our platform organically through word-of-mouth marketing. As a result, we have seen a decrease in our marketing and business promotion expenses as a percentage of total income," Groww mentioned.

Zerodha, Groww, Angel One see investor exodus in August 2025, smaller brokerages see uptick

The company stated that it has undertaken to spend an amount aggregating up to Rs 351 crore to GroupM Media India Private Limited for the purposes of branding and performance marketing.

'Groww financial highlights'

Groww's revenue from operations has witnessed a 49.5% jump in the past one year. The IPO-bound firm clocked a revenue of Rs 3,901.7 crore in FY25 as against Rs 2,609 crore in FY24. However, in the June quarter of the current fiscal year, the revenue dropped year-on-year to Rs 904 crore compared to Rs 100 crore in Q1 FY24. Groww derived 84.50% and 79.49% of revenue from broking services in FY25 and in Q1 FY26, respectively.

The brokerage firm turned profitable in FY25, registering a profit of Rs 1,824.3 crore after posting a loss of Rs 805 crore in the previous financial year. In the June quarter (Q1 FY26), Groww reported a profit of Rs 378 crore--up 11.8% YoY.

The NSE active client base of the discount broking platform stood at 12.58 million as of 30 June 2025, while the active user base stood at 14.38 million.