Gowthaman Ragothaman on how India’s ad industry has a ‘lazy targeting’ problem and why AI will not fix it

Gowthaman Ragothaman, a media, advertising and marketing veteran and founder of Saptharushi, predicts Indian consumers will willingly trade privacy for free ChatGPT access, raising fresh concerns about consent, data security, and platform power.

ADVERTISEMENT

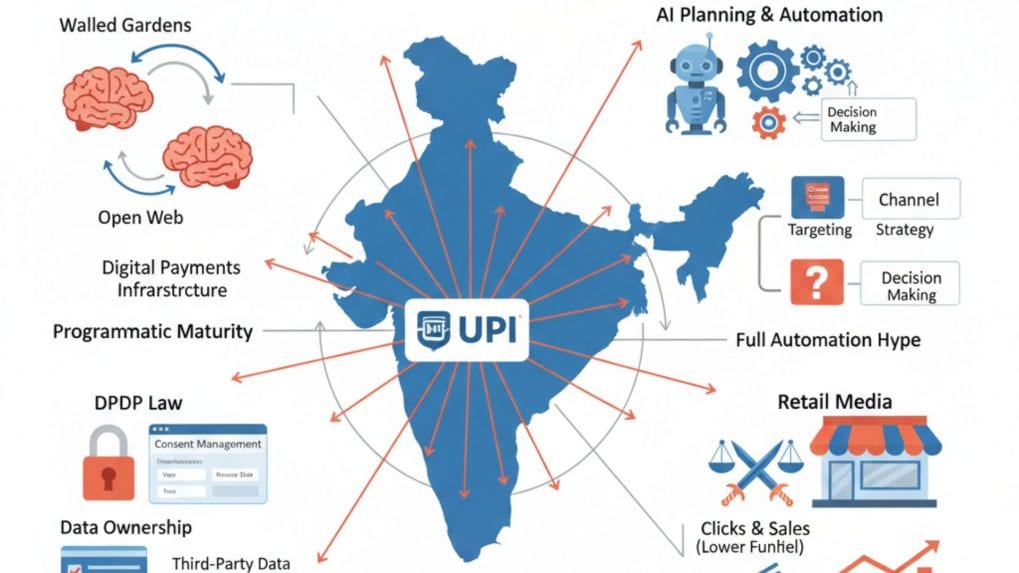

India’s advertising industry is maturing fast, Gowthaman Ragothaman, a media, advertising and marketing veteran and founder of Saptharushi, says the biggest risks today are not technology gaps but lazy targeting, overstated AI claims, weak data discipline, and an outdated agency business model. From calling account planning a vulnerable function to warning that retail media is being misused as a short-term sales hack, Ragothaman lays out why India’s AdTech future will be shaped less by Silicon Valley and more by UPI, QuickCommerce, and homegrown platform economics. He also predicts Indian consumers will willingly trade privacy for free ChatGPT access, raising fresh concerns about consent, data security, and platform power.

Edited excerpts:

If you had to summarize India’s AdTech moment today in one sentence, what is structurally different from even two years ago?

India’s programmatic maturity is significantly higher today than it was two or three years ago. Earlier, most programmatic advertising was limited to walled gardens and not the open web. That gap is now narrowing. Platforms, advertisers, and technology players have built stronger capabilities, and the ecosystem is finally maturing beyond closed environments.

Is this shift driven more by platforms, advertisers, or regulation?

It is largely driven by platforms. New-age platforms, especially Quick Commerce and digital-first businesses, are increasingly running their own ad ecosystems. They want to control ad serving directly on their owned destinations, which forces them to understand AdTech more deeply. That naturally pushes maturity across the ecosystem.

Is India still catching up to global AdTech trends, or are we now building our own model?

We are no longer just catching up. India is now playing its own game and setting its own rhythm. Our digital maturity is deeply shaped by UPI and India’s digital payments infrastructure, which is unique globally. We have created new global benchmarks in QuickCommerce and real-time payments.

This has also driven an outsized focus on performance marketing because actions are measurable instantly. You see a QR code, click, transact, and convert. That closed-loop measurement makes India less dependent on US-driven innovation. We are now innovating from here, on our own terms.

What do Indian marketers still misunderstand most about how AdTech actually works?

The biggest issue is what I would provocatively call lazy planning. Walled gardens have spoiled marketers by making targeting feel easy: “You take my data, I’ll take yours, build audiences, and serve ads.”

As a result, brands have deprioritized deeper audience understanding and segmentation. The discipline of truly knowing consumers has weakened. Privacy regulation is now forcing marketers to value their own data more and also evaluate the price-value equation of buying third-party data. That is the missing agenda and the biggest opportunity right now.

From a practitioner’s lens, where is AI actually delivering measurable value in Indian advertising today? And where is the hype exaggerated?

AI is heavily exaggerated in advertising right now. The most tangible value today is in automating campaign planning decision-making, not campaign execution itself.

For example, given a brand brief, AI can evaluate far more targeting, channel, and strategy options than a human planner can. It helps surface possibilities that humans might not even think of. That is real productivity gain.

But the idea that you can just press a button and AI will plan, build, execute, and optimize an entire campaign end-to-end is not real yet. Advertising is a supply chain involving agencies, platforms, DSPs, SSPs, verification partners, and marketing teams. Unless all of them have interoperable AI systems that talk to each other, true automation will remain limited.

There are early efforts like PubMatic’s Ad Context Protocol in the US, which is trying to standardize AI-to-AI communication across players. It is promising, but still early.

Which part of India’s DPDP law is most misunderstood by marketers?

Consent management. Most companies focus only on how they collect consent from users on their own platforms. That part is relatively understood.

What is misunderstood is the concept of a neutral, independent consent manager. DPDP proposes a centralized system, similar to an account aggregator in fintech, where consumers can view and revoke all their data consents across companies from one dashboard.

That means companies will not only need to collect consent, but also integrate with an external, neutral consent manager so revocations sync automatically. This is unique to India, and many enterprises have not fully internalized what this means operationally.

Retail media is being positioned as India’s third major advertising wave. What is the biggest mistake brands are making?

Brands are treating retail media like a candy store: list products, run ads, drive clicks, track sales.

That captures short-term performance but ignores upper-funnel brand building. Retail media is not just a sales channel. If brands fail to invest in awareness and long-term brand equity alongside retail performance, they risk losing mindshare over time.

If everyone focuses only on lower-funnel conversion, another brand will eventually own the upper funnel and win long-term loyalty. Retail media must be measured not just on clicks and purchases, but on brand lift and incremental impact.

How serious is ad fraud today compared to five years ago? Has AI helped or worsened it?

Ad fraud remains largely unchanged. The problem persists because verification is inconsistent. Fraud mitigation depends on three things: ensuring a human saw the ad, ensuring it appeared in a quality environment, and ensuring correct contextual placement.

Bots, low-quality “made-for-advertising” sites, and misaligned contexts still exist. AI has not fundamentally solved this problem yet. Without consistent, industry-wide certification and enforcement, fraud will continue.

Are Indian ad agencies becoming tech leaders, or are they still dependent on AdTech vendors?

They are still heavily dependent on AdTech vendors. And I do not blame them. Their business model is built around headcount-based retainers, not technology ownership.

Agencies sell people, not platforms. Clients expect manpower and thinking, not proprietary tech. Investing in technology requires new revenue models, capital, or partnerships. Historically, agencies outsourced tech to DSPs instead of building their own capabilities, which is why some AdTech companies today are valued higher than agency holding groups.

The current agency model is not sustainable. Holding companies are experimenting: some want to become SaaS platforms, others want to monetize consumer data. But the jury is still out.

Which part of the advertising ecosystem will become irrelevant faster than people expect?

Account planning. It has traditionally relied on consumer insights and contextual intelligence. But today, information is fragmented, markets are fragmented, and consumer behavior is fragmented.

AI can synthesize insights faster than traditional planning teams. Anyone can now run smart queries on ChatGPT, Gemini, or Perplexity and become highly informed very quickly. That shifts the value equation. Account planning is one of the most vulnerable functions.

What should regulators, advertisers, and platforms be debating more urgently?

Consumer data security and responsible data use. We already see how sensitive this is, especially with platforms like OpenAI entering advertising.

If consumer data is not regulated tightly, it can be misused for spam, tracking, profiling, and manipulation. Despite filters and rules, people still get daily spam calls. That means data is still leaking somewhere.

This data also feeds AI models. If we do not treat data protection seriously, AI will amplify existing harms. Consumer data governance should be a central industry priority.

What would Indian marketers need to see to justify spending on ChatGPT ads?

There are two types of ROI. The first is intelligence ROI. Tools like ChatGPT dramatically raise marketers’ knowledge, planning quality, and strategic thinking. That ROI is already high. For the next 12 to 18 months, this will be extremely valuable.

But once everyone becomes equally informed, that advantage becomes table stakes. The real ROI will come from proving that ads on ChatGPT drive incremental sales or outcomes. That will require structured A-B testing: performance with AI-powered targeting versus without it. That proof will take time.

India is price-sensitive but ad-tolerant. Will Indian users trade privacy for free ChatGPT access?

Yes, absolutely. Indians are highly motivated by free access. If given a choice between paying or giving up some data, most users will choose free.

Markets like Germany behave very differently and place a high monetary value on privacy. India historically does not. If ChatGPT or similar platforms offer free access in exchange for ads, Indian consumers will adopt it quickly.