India’s paints sector boom: Why senior executives see long-term opportunity

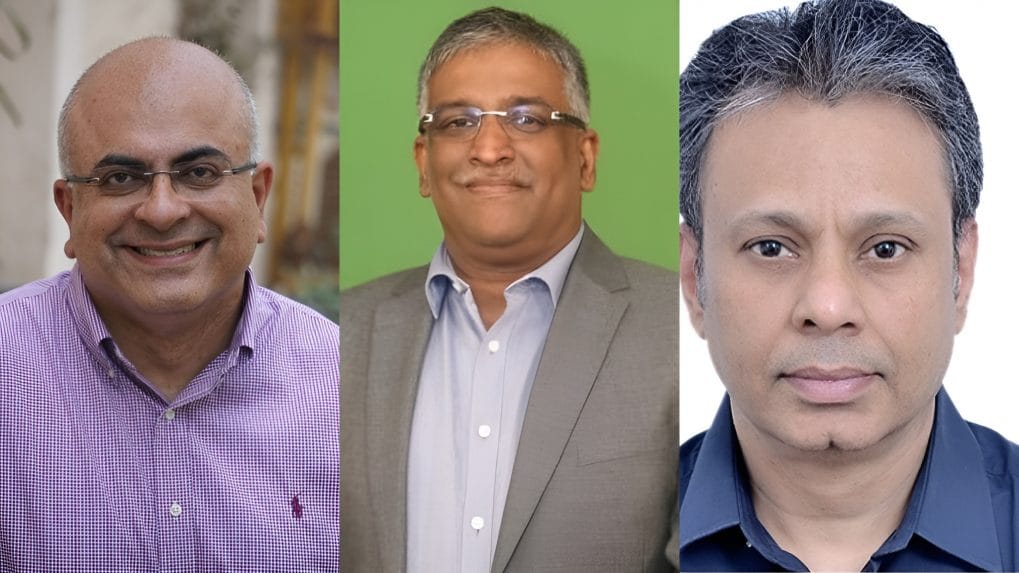

2025 has emerged as a watershed year across FMCG, consumer goods, fashion retail and now paints. With leadership churn continuing from last year and expected to persist, Storyboard18 spoke to industry experts to understand why the sector is attracting senior executives, the skills in demand, and the challenges facing the industry.

ADVERTISEMENT

If 2025 marked a watershed moment for India’s consumer sector, it also emerged as a defining year for the country’s paints industry—one characterised by high-profile leadership churn and strategic recalibration.

Traditionally viewed as a stable, low-volatility category dominated by a handful of incumbents, the Indian paints sector is now witnessing a steady influx of senior leadership talent from FMCG, automotive, telecom and large conglomerates etc. The movement reflects not short-term disruption, but a deeper structural shift as the industry prepares for its next phase of growth.

Big-ticket leadership moves reshape the landscape

In 2025, Sharad Malhotra was elevated to Managing Director of Nippon Paint India. Earlier, in 2023, Asian Paints appointed R. Seshayee, former vice chairman of Ashok Leyland, as chairman—one of the most significant cross-sector leadership appointments in the industry.

At AkzoNobel India, Rajiv Rajgopal, who joined the company in 2011 from Airtel as Director–Sales and Marketing and later rose to Managing Director, was elevated this year to Joint Managing Director and CEO.

Meanwhile, the entry of Grasim Industries’ Birla Opus Paints in 2024 has further accelerated the leadership movement. Sachin Sahay, formerly with ITC, joined Birla Opus as CEO this year, succeeding Rakshit Hargave, who exited to take on a leadership role at Britannia Industries.

New entrants, new leadership demands

According to Ashish Dhir, Senior Director (Consumer & Retail) at research and consulting firm 1Lattice, leadership churn is a natural consequence of new entrants reshaping a sector.

Read More: Why 2025 became a watershed year for CEO churn in India’s consumer sector

“When a new player enters, the first priority is building a capable leadership team. Naturally, companies look for experienced talent, often from within the same or adjacent industries,” he says. “Birla Opus’s entry intensified leadership hiring as it actively recruited seasoned professionals to scale quickly.”

Mergers and acquisitions have also contributed to the churn. JSW Paints’ acquisition of AkzoNobel last year, for instance, required senior leadership capable of managing integration while maintaining scale and operational efficiency.

Despite these movements, Dhir notes that the industry remains structurally consolidated. “Asian Paints continues to dominate, Berger Paints remains the second-largest player, while Birla Opus and JSW Paints are growing rapidly but within a relatively stable competitive framework.”

Capital intensity, distribution and growth opportunity

Structurally, the paints industry is capital- and distribution-intensive. India’s ongoing infrastructure development—across residential, commercial and office spaces—is driving steady demand. At the same time, premiumisation is accelerating as consumers upgrade to higher-quality paints and finishes.

“Despite strong growth, the category remains underpenetrated,” Dhir explains. “This creates a long runway, but it also demands leaders who can balance scale with discipline.”

Operationally, two challenges dominate: distribution intensity and working capital management. “Paint companies require extensive last-mile distribution networks and large manufacturing capabilities. Entry barriers are high, which is why leadership experience matters so much,” he says.

These realities have pushed companies to recruit leaders from FMCG, cement, chemicals and consumer durables sectors. “These industries deal with similar penetration challenges across urban and rural India and demand strong execution and operational discipline,” Dhir adds.

Execution over strategy

In paints, strategy alone is insufficient. “Execution is critical—strategy only works if it reaches the ground,” Dhir says. Leaders are expected to manage P&Ls, oversee large-scale operations and navigate India’s diverse regional markets.

The most complex challenge lies in managing last-mile distribution and dealer economics. “Margins are tight and must be carefully managed. Leaders need to balance operational efficiency with brand investment,” he notes.

Equally important is brand management—ensuring awareness, driving demand and managing the entire sales funnel. “Success requires disciplined brand-building combined with granular execution,” Dhir says.

Consumer shifts and the technology imperative

Changing consumer expectations are also reshaping leadership requirements. Sustainability, service quality and the preferences of younger consumers are influencing product choices and brand loyalty.

“Today’s leaders need strong consumer insight capabilities to anticipate shifts and align the organisation accordingly,” Dhir explains. Tech-savviness has become equally critical as digital tools, AI and data analytics reshape supply chains, customer engagement and operations.

“Technology becomes an advantage only when supported by the right culture and teams,” he adds. “With the right mindset, it enhances speed, efficiency and decision-making rather than increasing risk.”

Why the paint sector attracts top talent

Siddharth Verma, Head of Executive Search at staffing firm Xpheno, describes the Indian paint sector as one of the most structured consumer industries in the country.

“Its distribution and supply networks rival the automotive industry, yet it operates like a sophisticated FMCG and retail ecosystem,” he says. While a semi-organised segment exists, it represents a significant opportunity for large players to scale.

According to Verma, the sector’s prestige dates back to early movers who positioned paint as a lifestyle product rather than a commodity. “That mindset attracted Tier-1 talent and created a lineage of management excellence. Today, paints are a key CXO talent pool.”

Leadership churn, he explains, is driven by two forces. First, the sector is seen as a proving ground for consumer leadership. “Executives from paints are viewed as capable of handling almost any consumer-facing business.” Second, the entry of powerful new challengers from adjacent building materials segments has intensified demand for experienced leaders.

“When a group like Birla Opus enters paints, credibility is immediate,” Verma says. “The corporate brand lowers perceived risk, making it easier to attract leaders from established companies.”

From product to service-led ecosystems

As consumer expectations evolve, the industry has shifted from a volume-driven business to a value-driven lifestyle and service category. Managing unorganised labour—particularly painters—and integrating them into branded service ecosystems has become central.

“Paint is an ‘invisible’ product once applied,” Verma explains. “The challenge for leaders is creating strong brand recall for something that doesn’t visibly announce itself.”

Innovation has historically played a critical role. Verma points to Asian Paints’ introduction of “ColorWorld” technology, which transformed inventory management through base-and-tint systems. “It reduced wastage, improved availability and tightened the supply chain,” he says.

The road ahead: talent, culture and continuity

Looking ahead, the biggest risk is talent erosion. “We are witnessing a generational handover,” Verma says. “Companies can no longer rely solely on external hiring; they must build strong internal pipelines.”

The next growth frontier lies in added services—owning the entire consumer experience. “Even the best paint is only as good as its application,” he notes. Leaders must focus on ecosystem building, skill development and service branding, particularly by partnering with the painter community.

The challenge for the industry, Verma concludes, is twofold: competing for elite external talent while nurturing the next generation of leaders internally. As the paints sector continues to reinvent itself, leadership—not colour or finish—may well be its most decisive differentiator.