Wipro Consumer Care expands into packaged foods with strategic acquisitions and organic growth

In an interview with Storyboard18, Anil Chugh, president of the foods business, and Neeraj Khatri, chief executive of consumer care, India and SAARC Business, at Wipro Consumer Care and Lighting, share details on the company’s recent acquisitions, brand marketing strategies, and more.

ADVERTISEMENT

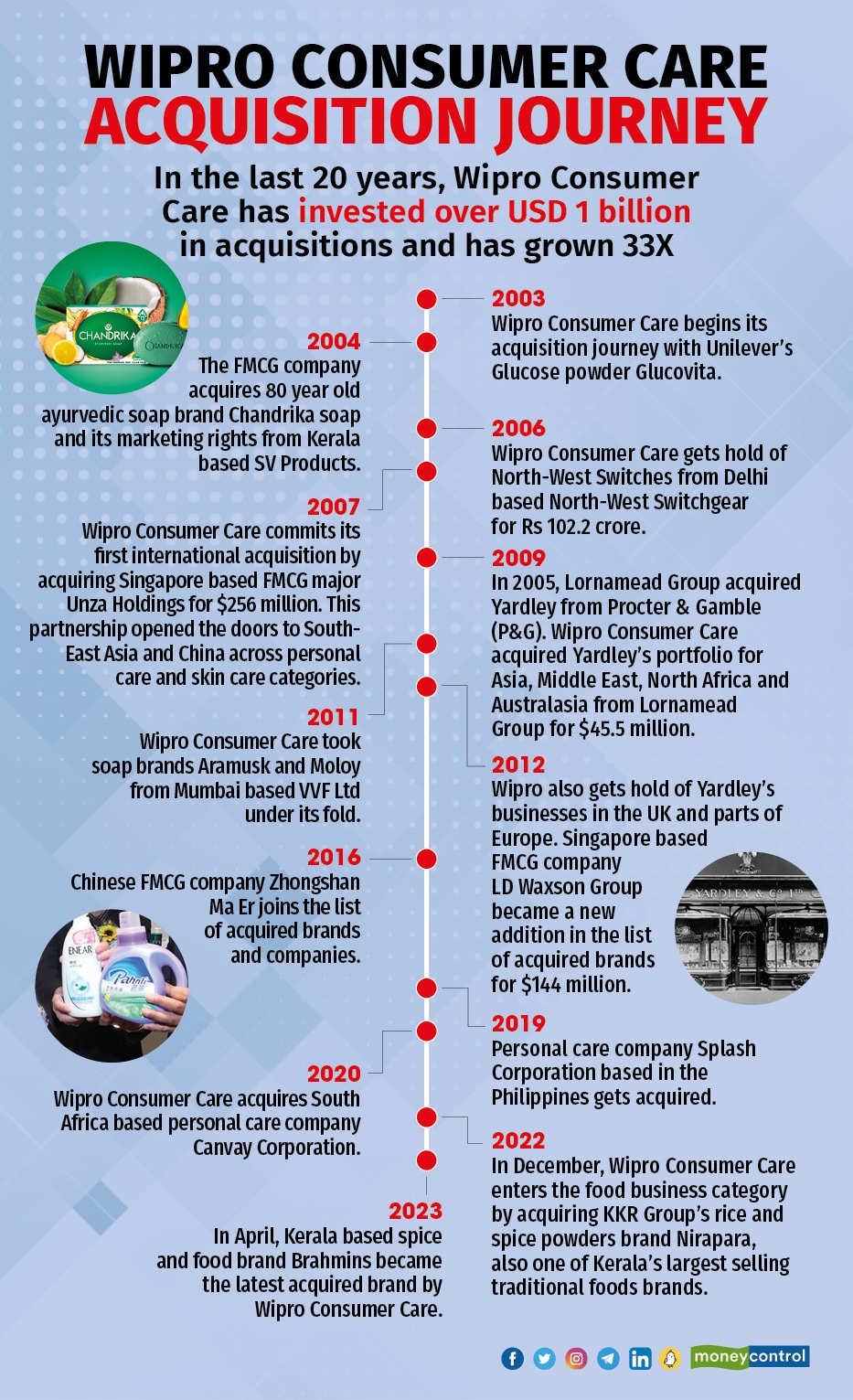

Wipro Consumer Care and Lighting has been betting big on acquisitions. In the last 20 years, the company has invested over USD 1 billion in acquisitions and have grown 33X.

Not so long ago, the personal care product company entered the food business through acquisitions. In December of last year, Wipro Consumer Care acquired Nirapara, a traditional food brand based in Kerala. Fast forward to April 2023, and the company completed its 14th acquisition by acquiring Brahmins, another Kerala-based brand specializing in traditional vegetarian spice mixes and ready-to-cook products.

From left to right: Anil Chugh and Neeraj Khatri

In an interview with Storyboard18, Anil Chugh, president of the foods business, and Neeraj Khatri, the chief executive of consumer care, India and SAARC Business at Wipro Consumer Care and Lighting, shared their acquisition strategies, bets on brand marketing, new launches, and more.

Edited excerpts.

Recently, Wipro Consumer Care acquired Kerala based food company Brahmins Foods. What was the strategy behind it?

Anil Chugh: The market size of the spices sector in the country is estimated at ₹72,000 crore and is growing at a CAGR of 12 percent. The blended spice market is estimated at ₹12,000 crores with a CAGR of 15 percent, and the ready-to-cook category is estimated at ₹3,400 crores with a growth rate of 19 percent. We entered the food category with our first acquisition of Nirapara. Within six months, we made our latest acquisition of Brahmins, which marks our 14th acquisition.

Brahmins have a strong heritage, leading the spice and ready-to-cook category with a significant consumer recall. Bringing it under the Wipro fold will strengthen our position in blended spices and ethnic breakfast categories.

What makes the category of packaged foods profitable for Wipro? Who are the target consumers?

Chugh: We have been in personal care, homecare and lighting in India and abroad. And when we were looking at categories to expand, we found food, specifically traditional snacks, and spices, to be fairly large. The traditional snacks category, including the unorganised sector, is about 3.5x the toilet soap category, which is around Rs 21,000 cr in India.

India remains our single largest market and continues to be our most important region.

Our decision to enter the packaged food business complemented our existing categories, thus building a holistic offering in the FMCG space. We aim to reach the Rs 500 crore milestone through this new business segment in the next three to five years. While this is purely through an organic route, it could hit this goal faster through acquisitions.

This space has a huge opportunity to shift consumers from an unorganised to an organised market. So, products will be higher priced than what is sold today, but they will be outside the premium price range. We are relatively strong in tier II, III, and IV cities. Therefore, that would be our focus from a consumer perspective.

Which are the other brands or food companies Wipro is looking to acquire?

Chugh: The acquisition of Nirapara and Brahmins is just the start of our journey to build a big presence in the segment. We are always open to additional partnerships and acquisitions. As far as spices are concerned, we will go through the acquisition route and do it organically for ready-to-eat snacks. We will also look at acquisitions in traditional snacks. But there are not enough players there. An acquisition is one of the many ways to enter this category.

Who are your competitors in the packaged foods business?

Chugh: We are looking at South India, which compared to North and West, has no organised players like a Haldiram or Bikano. Here the competition is from the unorganised and small-scale players. If we can give a value-added answer and a good product, we are sure consumers will switch.

What are the marketing and communications strategies that have been adopted or further will be adopted to leverage Brahmins and Nirapara to its maximum potential?

Chugh: All the marketing and communication is focused on generating customer trials for both the brands. We will focus a lot on sampling of our products. We may also leverage the digital medium to reach out to the consumer to tell our brand story.

Recently, a few packaged foods companies came under scanner for having high percentage presence of sugar and salt in their products. What according to you should food brands focus on in a world where consumers are well aware?

Chugh: We are seeing the growth of the conscious consumer inclined towards authenticity, individuality, and sustainability by tapping into local credentials and cultural aspects. This is driving the ascent of local brands, especially in tier II, III, IV markets.

We can see both new and legacy players adding the local touch and multinationals adapting to fit the needs of consumers across different cultures and geographies. Packaging is also becoming fascinating, with brands being more distinct, expressive, and unique in their content. The key focus is ensuring that the food brought to the consumers is safe, convenient, affordable, and offers true value.

What is the revenue of Wipro Consumer Care?

Chugh: We crossed the milestone of Rs 10,000 crore in overall sales in FY23, helped by significant growth across geographies, brands and categories. The domestic FMCG business grew by 17 percent. We have come a long way since 2003, when we were Rs 300 crores, to being a global FMCG company growing 33 X (times) in the last two decades.

In the last 20 years, we have invested over USD 1 billion in acquisitions and have grown 33X. This has been driven by strong organic growth of existing brands.

Does Wipro Consumer Care have plans to launch its own brand?

Chugh: We are in the process of launching our brand as far as snacks are concerned in our foods business. We are setting up an R&D facility in Bengaluru and anticipate this to happen in the next 9-12 months.

We can see both new and legacy players adding the local touch and multinationals adapting to fit the needs of consumers across different cultures and geographies.

Wipro Consumer Care acquisition journey

Could you detail the 20-year long journey of Wipro and its acquisitions?

Neeraj Khatri: Wipro Consumer Care and Lighting is among the fastest-growing companies in the FMCG space with a revenue of over Rs 10,000 crore. The product categories we operate in, include personal wash, personal care, skin care, wellness, home care, domestic and commercial lighting and seating solutions.

Fifty-one percent of our revenue comes from our international businesses and we have a strong brand presence with significant market share in the product categories we operate in India, Southeast Asia, China, Middle East and South Africa.

So far, we have completed 14 acquisitions globally. Our first three acquisitions were in India. Glucovita, a glucose powder brand, was our first acquisition from Unilever in 2003. This was followed by acquisition of Chandrika, an 80-year-old ayurvedic soap brand in 2004 and Northwest Switches in 2006.

Through our international acquisitions of personal care and home care brands, we have gained expertise which has enabled knowledge transfer and faster turnaround on our new product development.

In 2007, we made our first international acquisition of Unza Holdings, which gave us entry in South-East Asia and China across personal care and skin care categories. In 2009, we acquired Yardley, one of the most well-known legacy brands.

In 2012, we acquired Aramusk in India and LD Waxsons Group in Singapore, having well-known skin care brands such as Bio-essence. We strengthened our presence in China with the acquisition of Zhongshan Ma Er in 2016, which also gave us a foot hold in liquid detergents. This was followed with the acquisition of Splash Corporation in 2019 in the Philippines, and Canway Corporation in South Africa in 2020.

Our decision to enter the packaged food business complemented our existing categories, thus building a holistic offering in the FMCG space. We aim to reach the Rs 500 crore milestone through this new business segment in the next three to five years. While this is purely through an organic route, it could hit this goal faster through acquisitions.

In the last 20 years, we have invested over USD 1 billion in acquisitions and have grown 33X. This has been driven by strong organic growth of existing brands. And, we have been able to integrate, manage and expand market share of acquired brands across Wipro Consumer Care and Lighting geographies.

India remains our single largest market and continues to be our most important region. Here, we are growing well in our key regional markets and expanding into adjacent markets through a deeper distribution network.

Which are the other categories or areas Wipro Consumer Care is planning to explore?

Khatri: Our India FMCG business grew at 17 per cent in FY ’23. Here, one of the biggest success stories has been our flagship brand Santoor. It is the second largest brand of toilet soap with sales of over ₹ 2,650 crore. With Santoor and Chandrika in personal wash, Yardley and Enchanteur in personal care, we continue to expand into adjacent categories with meaningful extensions. These brands drive our personal care ambition.

Beyond personal care, we have expanded into fabric wash with Safewash, fabric softeners with Softouch, dish wash with Giffy and into floor cleaners with MaxKleen. Our focus in these categories is to strengthen the brand presence with product innovation.

We are a leading skin care company in the evolved skin care markets of Singapore and Malaysia and want to leverage our skin care expertise across geographies. For example, we are building our D2C play in India with our marquee skin care brand Bio-essence. Bio Essence has a range of skin care products under Bio V-lift and Bio Gold ranges. Bio V lift cream is a revolutionary product which is targeted towards young mothers which gives 6mm skin firming in ten minutes.

According to you, how has marketing and advertising at Wipro Consumer Care evolved over the years?

Khatri: The strength of Wipro has always been identifying the right market, consumer insight and proposition and consistently delivering on the message. For example, we launched Santoor Soap in 1986 and since the beginning we have stayed true to the proposition of younger looking skin with Santoor.

While the proposition has remained the same, over the years, we have upgraded the brand, contemporised the messaging and continue to do so relentlessly. Today, Santoor is India’s number one toilet soap brand in South-West India, our markets of choice and the number two toilet soap brand all-India.

In the past few years, we have also created a strong portfolio in the home care segment where we have expanded our footprint. Today, we have brands such as Softouch, Safewash, Giffy and Maxkleen which are growing well in our key states and expanding into adjacent markets. We are now designing marketing campaigns at a state level identifying relevant pain points and consumer insights. We are executing outdoor campaigns and activations at a hyper-local level in smaller town classes and rural India.

Through our international acquisitions of personal care and home care brands, we have gained expertise which has enabled knowledge transfer and faster turnaround on our new product development.

We have increased our digital marketing and e-commerce marketing focus. We deploy 20 percent - 25 percent of media spend on digital media to target the new age consumer with varied content and messaging.