End of an era: Mark Read's legacy and the future for WPP India

In 2025, WPP lost its crown as the world’s largest ad network, with major clients like Coca-Cola and Paramount walking away. Employee unrest and plummeting market value added to the mounting pressure on Global CEO Mark Read.

ADVERTISEMENT

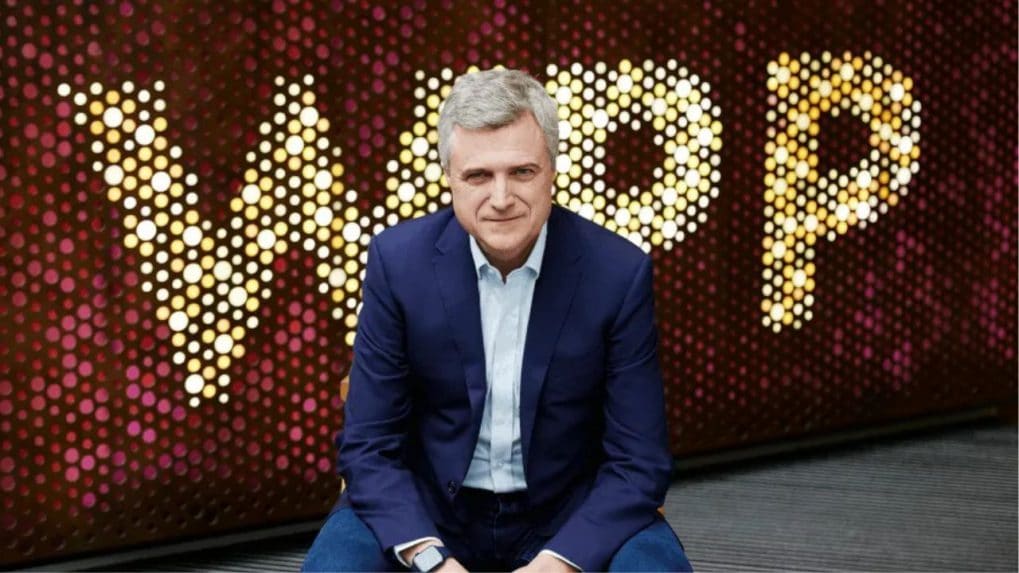

WPP CEO Mark Read’s decision to step down by the end of this year ends a seven-year tenure as WPP boss defined by deep structural changes, consolidation and an aggressive pivot toward AI and data-led marketing. While Read called it a “privilege” to lead the world’s largest advertising network — until recently, industry insiders say his departure signals far more than just a leadership transition.

Read took over in 2018, in the shadow of WPP founder Martin Sorrell’s dramatic exit. His mandate was clear: simplify, stabilize and modernize the group. Under his leadership, WPP merged iconic agency brands like JWT and Y&R into VML, and restructured its media portfolio with the creation of EssenceMediacom and the recent rebranding of GroupM as WPP Media. Investments in AI such as the acquisition of InfoSum and the development of WPP Open signaled a future-facing approach.

But in 2025, WPP was dethroned by Publicis Groupe as the world’s largest ad network by revenue. Coca-Cola’s $700 million US media business moved to Publicis. Paramount walked away after a two-decade relationship. Employees revolted against Read’s rigid return-to-office policy. Shareholder pressure mounted as WPP’s market cap sank to a four-year low.

Read More:“We are ultimately a people business,” says Mark Read as AI reshapes WPP workforce

Advertising industry veteran Naresh Gupta, says, “The share price is falling, market valuation is down and they have private equity investments — I’m sure those investors are putting pressure. As an organization, they seem reactive, knee-jerk.”

Mark Read’s exit signals deeper strategic fatigue, not just routine change, say industry observers.

They highlight it's a bit strange that the exit is announced after all the downsizing and rightsizing has been done already globally. "Seems like he played the bad cop for all exits before he was asked to exit. I don’t believe in the AI story,” said Shubho Sengupta, Digital Marketer.

India, for now, offers a fast-growing and stable market in WPP global map. WPP has historically dominated the local market led by the creative weight of Ogilvy and the scale of GroupM.

However, Tarun Rai, former Chairman and Group CEO of Wunderman Thompson South Asia and currently Co-Chairman, Start Design Group warns, “With constant mergers, or now more turmoil with a change of global leadership, agencies start to focus internally. In a client-facing business like ours, getting too internally focussed and taking the eye off the clients' business and issues, is a real danger. Clients can lose patience."

For many veterans, Read’s tenure will be remembered not just for bold reinvention but for what was also lost in the name of simplification. That emotional undercurrent — the feeling of legacy lost is echoed across geographies.

“Mark Read's task after the departure of Sir Martin Sorrell was to heal. He however decided to trim - and that became the hallmark of his innings. The WPP group has remained in perpetual turmoil throughout his tenure, losing its long reigning supremacy...I started my advertising career at Thompson. You couldn't believe they killed the brand. VML is not a fraction of the juggernaut JWT was. So the rejigging has only been about value destruction,” stated Sandeep Goyal, Managing Director at Rediffusion.

Mark Read’s departure doesn’t just close a chapter for WPP; it throws open questions about the identity, leadership and future-readiness of the world’s once-dominant ad empire. As India’s market becomes more competitive, and clients seek relevance over legacy, the kind of leadership that emerges in the coming months — both globally and locally will determine if WPP can take the top spot again, or be remembered as a giant that shrank itself.

Read More:WPP unveils AI-Powered WPP Media, replacing GroupM in major strategic shift