Riding on GST 2.0 boost, Mercedes-Benz India eyes ‘best-ever’ festive season with 25% higher ad spends

With GST reforms boosting disposable income and luxury sentiment, Mercedes-Benz India expects record festive sales, expanding its digital-first marketing, ₹450 crore retail investment plan, and growing omni-channel sales base.

ADVERTISEMENT

Mercedes-Benz India is steering into what it calls its 'best-ever festive season', with Managing Director and CEO Santosh Iyer attributing the momentum to GST 2.0 reforms, which have bolstered household spending and fuelled record Navratri sales. Despite global macroeconomic headwinds, Iyer believes Indian luxury consumers remain "aspirational and confident", as the brand sees strong traction across its core and top-end portfolios, including the S-Class, Maybach, GLS, and AMG G63.

To capitalise on this festive sentiment, the automaker has increased its ad spends by 25%, rolling out its large-scale ‘Dream Days’ campaign, spanning print, digital, OOH, CTV, influencer, and retail activations, shares Brendon Sissing, Vice President, Sales and Marketing, Mercedes-Benz India. The media mix follows a 60:40 ratio between traditional and digital, reflecting Mercedes-Benz’s belief in the emotional power of traditional media paired with the reach and precision of digital platforms.

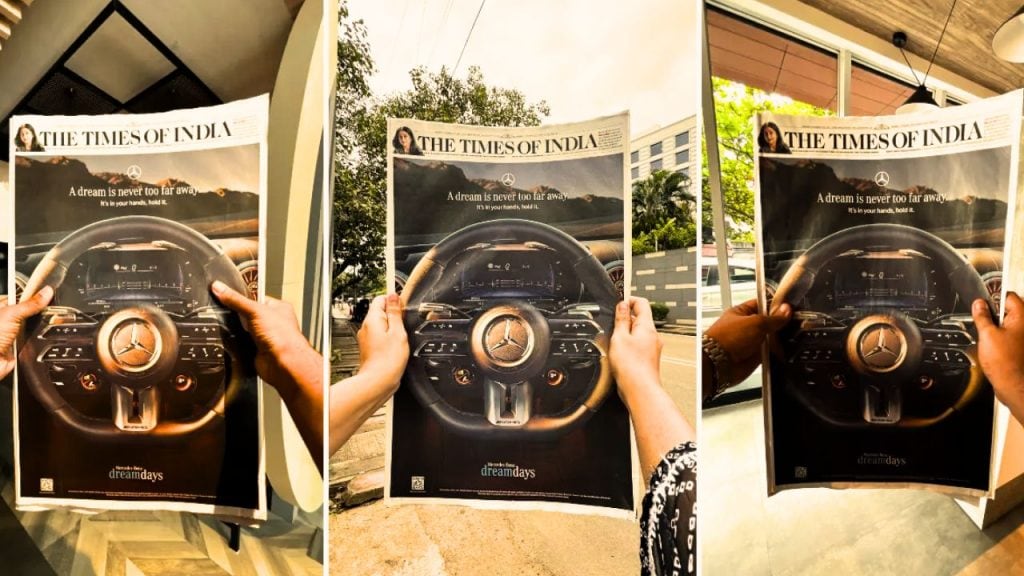

The campaign’s creative centrepiece - a steering wheel visual on front-page print ads - has gone viral online, while a digital film, “Dreams of India through the Eyes of Mercedes-Benz,” runs across CTV, YouTube, and Meta channels.

Looking ahead, Mercedes-Benz India is doubling down on digital transformation, AI-led personalization, and retail expansion.

The brand operates the largest luxury sales and service network in India with 140 touchpoints across 50 cities, with franchise partners set to invest ₹450 crore over the next three years to build new luxury showrooms and lounges. Around 15–20% of its total sales now come through online channels, a share that continues to grow each year.

Read more: GST 2.0 likely to lift festive cheer: India’s AdEx set to top Rs 55,000 cr in FY26, up 18–20% YoY

With a ₹3,000 crore investment in local manufacturing, including two locally produced all-electric models, the company expects the luxury auto market to outpace overall PV industry growth in the next few years- driven by premiumization, electrification, and sustained consumer confidence.

Edited excerpts:

How have you increased your advertising and marketing spends for this festive season?

Sissing: In general, the festive season experiences strong seasonality and sees an increased allocation of marketing budgets, with monthly marketing spends about 20% to 25% higher than average months. It is not about spending more; it's about spending smarter like using the front page of a newspaper to put a Mercedes-Benz steering wheel in the hands of billion of Indians.

The festive season campaign -'Dream Days' has been one of our biggest festive campaign and pans across print, digital, OOH and CTV, influencer and retail activations. We have seen around 25% increase in our ad spends around this festive period.

It is a 360-degree festive campaign with a focus on creating quintessential Mercedes-Benz luxury experiences for customers at every touch point, offering innovative financial solutions on the back of strong ATL and focused on ground campaigns. For customers, the campaign offers innovative financial solutions that aim at encouraging them to pursue the purchase of their dream Mercedes-Benz.

On the traditional front, Mercedes-Benz has impactful print ads which are made more popular with digital virality, strategic OOH across key cities and something simple, yet powerful. A coffee table ‘Dream Book’ for instance, has been presented to every customer who walks into the dealership, enhancing the customers’ connect with the brand.

From a festive season standpoint, the spends on traditional medium and digital medium are at 60:40 ratio for this campaign.

How have your investments in digital grown over the last few years?

Sissing: In last five years, Mercedes-Benz has witnessed a gradual increase in digital ad spends, especially with effectiveness of platforms such as CTV, Programmatic, Meta, Aggregators, among others. As customers become increasingly tech-savvy, we see more engagement and leads coming from digital platforms. However, 'personal touch' remains key for luxury car customers, and our goal is to simplify every customer journey across different platforms and create a personalized experience using digital insights, AI, and personalization.

Read more: Jewellery brands boost festive ad spends by up to 45% despite Trump tariffs and gold price surge

Meanwhile, influencers and 'friends of brands' are pivotal in delivering the right message to the right audience. In this case, we place utmost importance on authenticity and people whose values align with our brand and resonate with our audience. Many of them are already customers and good-will ambassadors so our engagement is more about creating 'money can't buy experiences' for them to create content rather than spends. This involves making them part of unique experiences ranging from Graz Drive, F1 Paddock, Ice Drive to North Pole, AMG Track Experiences etc.

How is Mercedes-Benz India leveraging AI in marketing?

Sissing: With industrial 4.0, globally, the entire value change is getting digitized with robotics and AI transforming industrial production processes fundamentally. Applications like Open Universal Scene Description (OpenUSD) are developing industrial digitization like ‘Digital Twins’. With ‘Digital Twins’ for production, assembly lines are getting planned, retooled and virtually inspected.

Read more: AI and Universal Content IDs are ending OTT chaos, says Nielsen-owned Gracenote's CTO

With the leverage of digital tools and applications OEMs are directly interacting with suppliers, reducing the coordination processes, while improving cost efficiencies. Mercedes-Benz has a digital-first approach for its manufacturing ecosystem, making it highly cost-effective, agile, resilient and future ready.

In marketing, we are creating AI use cases for optimization of ad spends, monitoring funnel leakage and ensuring sharper targeting of prospects and customers. There are many platforms and tools to pilot these use cases, but our primary goal will always be to create a simple and personal customer journey which is expected of Mercedes-Benz.

How has Indian consumer sentiment towards luxury cars evolved this year?

Iyer: This years’ festive season is turning out to be the best ever, owing to GST 2.0 implementation, which resulted in record Navratri sales for Mercedes-Benz. The Indian customer continued to be enthused by the luxury segment, particularly to Mercedes-Benz’s Core and Top-end portfolios.

Read more: From Talent Factories to Open Markets: Why FMCG giants are looking outside for CXO hires

While macro-economic and geo-political uncertainties continue to weigh pressure, Indian luxury consumers remain both aspirational and confident. There are certain headwinds such as tariffs and exchange rate volatility; however, the fundamentals of the economy remain strong, supported by positive GDP growth, robust capital markets, and strong corporate earnings.

Which Mercedes-Benz models are you betting on the most this festive season?

Iyer: Our top end vehicles like the S-Class, Mercedes-Maybach, GLS, AMG G63 remain the most desired luxury cars in the market today, setting new sales record this festive season.

Similarly, our core segment comprising the LWB E-Class, C-Class, GLC and GLE SUVs retained their customer preference and clocked best-ever sales record. Our entry segment vehicles like the GLA SUV also retained customer loyalty, having substantial product substance compared to competing products.

Talk to us about the steps you have taken towards 'Atmanirbhar Bharat' and local manufacturing?

Iyer: We take a lot of pride in our state-of-art manufacturing facility in Pune, having cumulative investment of ₹3,000 crore, the highest in the luxury segment. We locally produce 11 luxury cars comprising both ICE and BEVs under one roof. Notably, Mercedes-Benz is the only luxury brand in India to locally manufacture two all-electric luxury cars: the EQS 580 sedan and EQS 450 SUV. Local manufacturing helps us support India's manufacturing ecosystem, at the same time passing on the duty benefits to end consumers. Our investments in the market will continue to bolster our local production, as India is a high priority market for Mercedes-Benz AG.

How do you expect the luxury auto market to grow in the next two-three years?

Iyer: Mercedes-Benz expect the luxury auto market to grow slightly better than the PV industry in the next two-three years.

With GST reforms, households across metropolises and mini metros will have higher disposable income as aspiration will keep soaring further. We expect a steady rise in luxury consumption overall that will also influence luxury car purchase.

Share your current retail footprint and expansion plans? What's the current split between online and offline bookings?

Iyer: Mercedes-Benz India operates one of the largest luxury sales and service networks with ~140 touchpoints in over 50 cities. This year we have inaugurated facilities in 6 new cities with an increment of 15 touchpoints for our customers.

Our franchise partners are highly committed and will invest approximately Rs 450 crores in three years in building luxury touchpoints.

Read more: We strive to be globally knowledgeable while being locally relevant: Gianmauro Vella of PepsiCo

In an omni-channel journey like Mercedes-Benz, every customer begins their journey online, ending up offline to experience the delivery of the car. Pure online will still be around 15 to 20% of our total sales in Indian market and this is growing each year.

What are your growth drivers and strategy for FY26?

Iyer: Premiumization remains our core strategy with key focus on top-end model launches, accelerating electrification, and continuing our retail expansion. We are looking at a sustainable profitable growth amid headwinds like currency volatility, rising input costs, leading to pricing challenges. However, for us, it's about quality growth, not just numbers.